2019 Industry Outlook: The Year of the Active Manager

I always try to take a step back over the holidays and reflect on the prior 12 months. It is easy to forget how much can happen in a year. 2018 was no different, packed full of noteworthy headlines, and handful of notable firsts. France winning the World Cup, the Eagles winning their first Super Bowl, Apple becoming the World’s first trillion-dollar company, Michigan and Minnesota simultaneously electing the first Muslim women to Congress, a children’s soccer team was rescued from a cave in Thailand, a Royal Wedding and Virgin Galactic’s first manned venture into space, just to name a few. However, as the holidays wrap up, I inevitably start to look ahead, and think about what 2019 has in store.

Below are my contemplations on what 2019 may bring in terms of market performance, investor preferences, and industry trends … particularly for the fixed income investor.

From monetary policy expectations and a volatile stock market, shaky economic indicators in developed markets, and advances in technology, my view is that investors will need to take an active approach in terms of both investing and managing their businesses in order to be successful in 2019.

1. Federal Reserve Policy

No discussion regarding the fixed income market can be considered complete without a review of the current interest rate environment. At the latest FOMC meeting in mid-December, Fed Chairman Jerome Powell announced the fourth incremental interest rate hike of 2018. The 25 bp increase brings the Fed Funds rate to a range of 2.25% – 2.50%.

Following the announcement, the S&P and DJIA sunk toward 15- and 14-month lows, respectively. According to James Paulson, chief market strategist at the Leuthold Group, the pullback was due to investor’s belief that the “Fed is going to overdo it” with future rate hikes, rather than the market not appropriately pricing in this rate hike.[1] Evidently, there is a disconnect between the Fed and the White House regarding monetary policy, as indicated by President Trump’s recent Twitter activity, and the December rate hike. Amid falling markets, Powell indicated that officials “now think it is more likely the economy will grow in a way that calls for two rate increases next year,”[2] fewer than were originally anticipated. Nonetheless, market analysts are forecasting a slowdown in U.S. economic growth for 2019. Goldman Sachs expects growth to slow to 1.75% by year end and economists at Morgan Stanley are predicting a growth rate of 1.7% for 2019, the slowest pace since 2012.[3]

Market participants, President Trump included, have become reliant on Fed policies to be supportive of consistent, albeit marginal, economic growth. Contrary to Powell’s policies, it is easy to advocate for no rate increases for the foreseeable future given the expected slowdown in U.S. economic activity. However, market pundits seem to think that an independent Fed will revert to pre-crisis policy objectives where natural market cycles will be left to run their course and the largest bank in the land will take less reactive measures when it comes to current market performance.

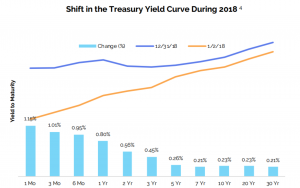

As shown above, Fed policy has resulted in a substantial flattening of the yield curve in 2018. Yields on the short end of the curve have risen ~100 bps compared to 21 bps for the 30 year.

Looking toward 2019, a survey of economists by the Wall Street Journal provides additional support for the notion of the Fed raising rates only twice in 2019. While data might suggest a yield curve inversion between the 2- and 10-year treasuries as increasingly likely, we don’t believe an inversion in 2019 is necessarily a sign of an impending recession as many investors have indicated. As Ryan Detrick from LPL Financial notes, “Prior to the last five recessions, the S&P 500 peaked 19 months on average after the yield curve inverted.” Investors who sold at the yield curve inversion missed out on average gains of 22% during those five periods. According to Oppenheimer’s chief investment strategist, John Stoltzfus, “the worst of the declines experienced by stocks in 2018 are behind us,” and that multiple expansion may result in a “global equity rebound in the coming year.” We agree with Oppenheimer and urge investors to remain patient and recoup recent losses as the (hopefully) markets rebound in 2019.

2. Global Economic Conditions Favor High-Quality U.S. Based Assets

In the fourth quarter of 2018, market performance deviated from the consistently positive U.S. economic indicators. Looking to the latest Jobs Report, the 312,000 and 2.68 million jobs added in December and FY 2018, respectively, provide evidence that it is unlikely there will be a widespread contraction across the U.S. economy in 2019. However, it is still hard to say if the U.S. credit cycle is in its late innings or still has a few at bats left.

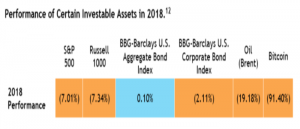

Nobody can identify the principle cause of the 4th quarter market downturn, particularly after the last few weeks of market turbulence – it feels as if the storm has not yet passed. While every major asset class ended the year in the red, the broad economy continues to demonstrate solid performance and corporate earnings are still expected to reach record highs in 1Q’19. According to Jamie Dimon, CEO of JP Morgan, the December pullback was unwarranted and the “markets are overreacting to short-term sentiment around a whole bunch of complex issues.” We agree with Mr. Dimon, for the last 8-10 years investors have experienced little else besides up and to the right performance. Skittishness is to be expected now that volatility has been reintroduced to the markets, as demonstrated by the 160% increase in the VIX during 2018. It’s clear that no one wants to be caught holding the bag when this tremendous bull market finally does come to an end.

The markets underperformed in 2018 despite robust U.S. economic growth. U.S. real GDP growth in 2018 is on track to outpace 2017 posting an annualized rate 3.4% through Q3’18, compared to 2.3% growth for full-year 2017.[13] The U.S. labor market continued to improve in 2018 with the unemployment rate dropping to 3.7% in November, the lowest November figure since 1966.[14] For the same period, nominal wages grew by 3% YoY, the largest increase since 2008.[15] The strong growth recorded in 2018 can at least partly be attributed to recent fiscal policy changes, the initial impact of which is not expected to continue in 2019. While there may be a decline in the growth rate of corporate profits, increased wages should lead to increased consumer spending to at least partially offset that decline.

All that said, there isn’t one developed or emerging market outside of the U.S. that looks particularly compelling. With annualized European GDP growth coming in at 1.9% in Q3’18, the has dramatically underperformed the U.S.[16] Europeans will need to come to agreement on several looming policy decisions that stand to create serious economic issues, if not appropriately addressed. Namely the uncertainty around Brexit and potential threat of a 25% tariff on European auto exports to the U.S., coupled with increasing geopolitical tensions and protests (à la the Yellow Vest movement) among the working population. While the unrest is undeniably unsettling, it seems that the powers that be will keep Europe on path to maintain its slow but steady path toward economic stability.

Emerging markets may be a different story. Given significant differences in the economic drivers of the various emerging market economies it’s difficult to evaluate them in aggregate. A strong U.S. dollar, tighter monetary policy, protectionist trade policies, and advances in technology reducing demand for labor are all structural impediments to EM prosperity. Due to the aforementioned headwinds, Morgan Stanley estimates slowing but still above trend growth for EM economies.[17] Falling oil prices, which closed 2018 at their lowest mark since mid-2017, pose the greatest risk of dragging down the performance of EM credits.

We agree with Blackrock[18] and favor high-quality domestic assets relative to European or EM investments. While the last three months of 2018 may have left you feeling bearish, now may be the time to ‘buy the dip’ and capitalize on recovery opportunities as they present themselves throughout 2019. There is money to be made from oversold European markets and select emerging market economies, but cautious investors will be best served in the upper reaches of U.S. IG.

3. Active Management Should Outperform

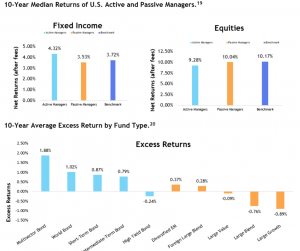

Within fixed income, we are advocates for active management relative to passive strategies. While this runs counter to the commonly held belief among equity investors that passive strategies outperform, the size and structure of the bond market provides active managers with a greater opportunity to generate alpha.

The increased uncertainty and volatility that has recently crept into the global markets should only exacerbate the outperformance of active fixed income managers. Given that passive investors might expect to achieve performance matching the ~3.3% yield on the Bloomberg-Barclays Aggregate Index[21], even modest outperformance due to active management, which compounds annually, can have a material impact on long-term returns.

An additional tailwind benefiting active fixed income managers is their ability to invest in a broader swath of the fixed income market than benchmark-tracking passive managers. For instance, the Bloomberg-Barclays U.S. Aggregate Index excludes roughly ~$21 trillion in market value of fixed income securities. Active managers with broader mandates are well positioned to capitalize on attractive investment opportunities in less covered sectors of the bond markets.

4. Technology Infrastructure Becomes a Source of Alpha

Fixed income investors must be primed for action in 2019. This year asset managers will be faced with the increasing electronification of the bond markets, stricter regulations, greater demand from clients for detailed reporting, and the likelihood of choppier markets. These headwinds can lead to lower expected returns for investment performance, however, technology can mitigate the operating costs borne by investors, maximizing total return regardless of broad market performance. Given the overwhelming abundance of market data and issuer credit information, decision-enhancement tools and digital trading venues will provide unique investment opportunities to generate alpha for the forward-thinking bond manager.

Digital infrastructure will become more of a competitive differentiator than ever before.

Up until recently, the fixed income industry has avoided the level of technological innovation that has revolutionized the equity markets over the last several decades. For instance, 80% of bond trades are still executed telephonically compared with less than 25% of equity trades, and transaction costs on bond trades can be nearly 9x those of comparably sized equity trades. The TABB Group recently surveyed asset managers in North America and Europe to assess the negative impact of utilizing antiquated systems. TABB reported that over 30% of North American asset managers responded they were not able to generate accurate cash position details for a portfolio using their existing technology systems. This is very unsettling. A substantial amount of client capital is being managed by investors who are flying blind.

With advances in cloud technology, big data analysis, machine learning, and AI we expect 2019 to be the year that digitally advanced teams begin leveraging innovative technology to realize operational efficiencies at their firms. From decision-enhancement and risk analysis to data validation and trade reconciliation, fixed income asset managers are better positioned than ever before to employ software platforms to drive value for their clients while scaling their businesses.

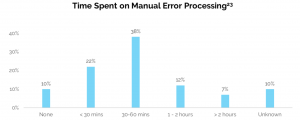

The costs of continuing to rely on outdated technology are difficult to ignore. The same TABB survey mentioned above found that 58% of asset managers’ front office staff allocated over 30 minutes each, per day to manual error processing and “one-fifth of asset managers spent more than an hour a day on non-automated tasks,” a very expensive proposition. Only 10% of survey respondents had no manual processes as part of their investment operations workflows. Translating this lost time into dollars, 20% of survey respondents indicated that time spent manually resolving errors amounted to opportunity costs totaling over 10% of revenue.[22]

The application of new technology will not only lead to improvements in operational efficiency, but also address a myriad of compliance concerns, both client-driven and as a result of new regulations such as MIFID II. According to Andrew Dassori, CIO of Wavelength Capital Management, “In the next generation of fixed-income investing, winners will not be determined by who you know, but how you separate signal from noise.”[24] Taking Andrew’s comment a step further, it is our view that technology will be critical in assisting asset managers to identify those signals.

Conclusion

2018 proved to be a universally challenging year. Choppy markets were coupled with political discord and a lot of mixed signals from Washington. Fixed income asset managers will need to be increasingly vigilant in order to achieve targeted returns for investors. With monetary policy tightening expected to continue at a more modest pace, risk-off assets outperforming risk-on, active managers benefiting from greater volatility, and advancements in technology, there is much opportunity for managers to differentiate themselves in 2019.

Read more in our 2019 Fixed Income Industry Outlook whitepaper.