Strong Bond ETF and Muni Recoveries as Markets Look Positive

Stocks recorded their best weekly gain in two months as investors optimistically reacted to signs of the beginning of an economic recovery. Equity markets appreciated for the third week in a row and Treasury yields rose to a 3-month high following a surprising gain in payrolls last month. The U.S. economy added 2.5 million jobs in May, while the unemployment rate declined to 13.3% from April’s record level, suggesting that an economic recovery is under way faster than previously thought. There is a large amount of uncertainty around the credibility of the jobs reports, as furloughed workers were not considered in the unemployment report and the agency admitted the real unemployment rate likely exceeds 16%.

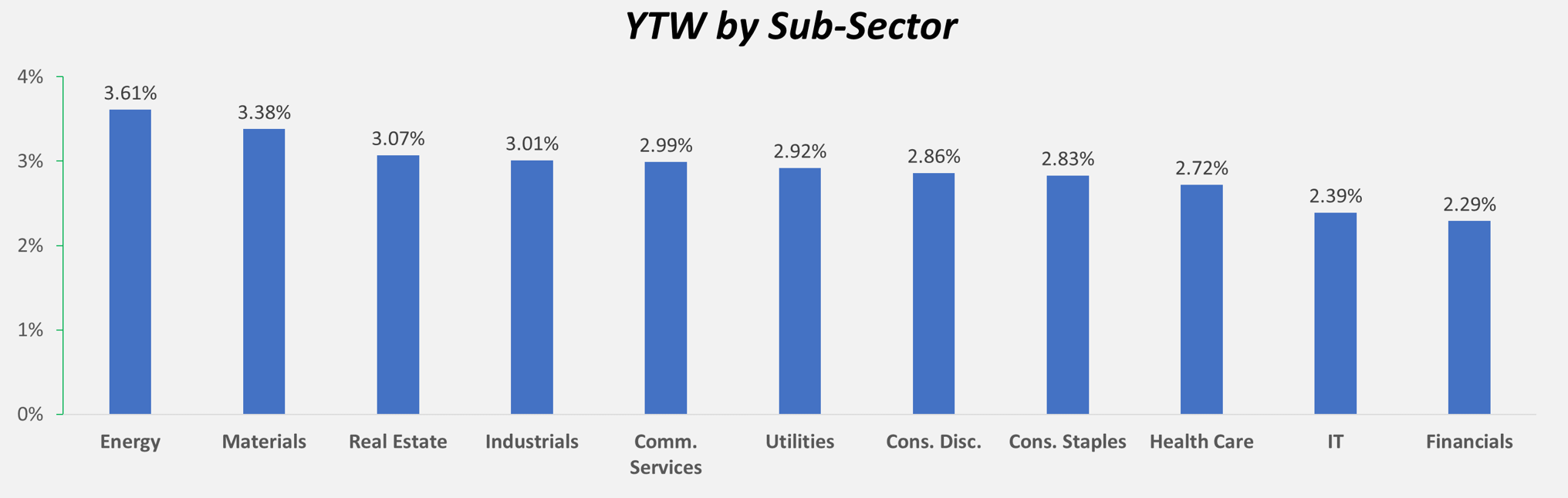

Even though economic activity will likely take a while to return to pre-crisis levels, last week’s employment data and the support of higher energy prices can be considered strong indicators that a long-term recovery is ahead of us. Following last week’s rally, the S&P 500 has now erased its losses for the year. Equities were led by small-cap names, as the index returned 8%, with energy outpacing the broader market and value stocks performing better than growth. Baskets of technology names are now within ~5% of all-time highs seen in mid-February.

Bond market sees strong bid from ETF investors

U.S. fixed income ETFs saw $13 billion of new money during the week, outpacing equity ETFs as investors took advantaged of lower prices on the back of better-than-expected economic data. The U.S. 10-year Treasury yield topped 0.9% for the first time since March 20, after a much better than expected jobs report. LQD saw the largest increase in inflows, which is driven by the direct funding from the Federal Reserve. However, ETFs across the investment grade and high yield space saw large volume of new money, tightening spreads to near 3-month lows. Long term investors are the real losers due to the large outflows in March and April and followed by the increased inflows in May and June; this is one reason why asset managers should reconsider bond ETFs.

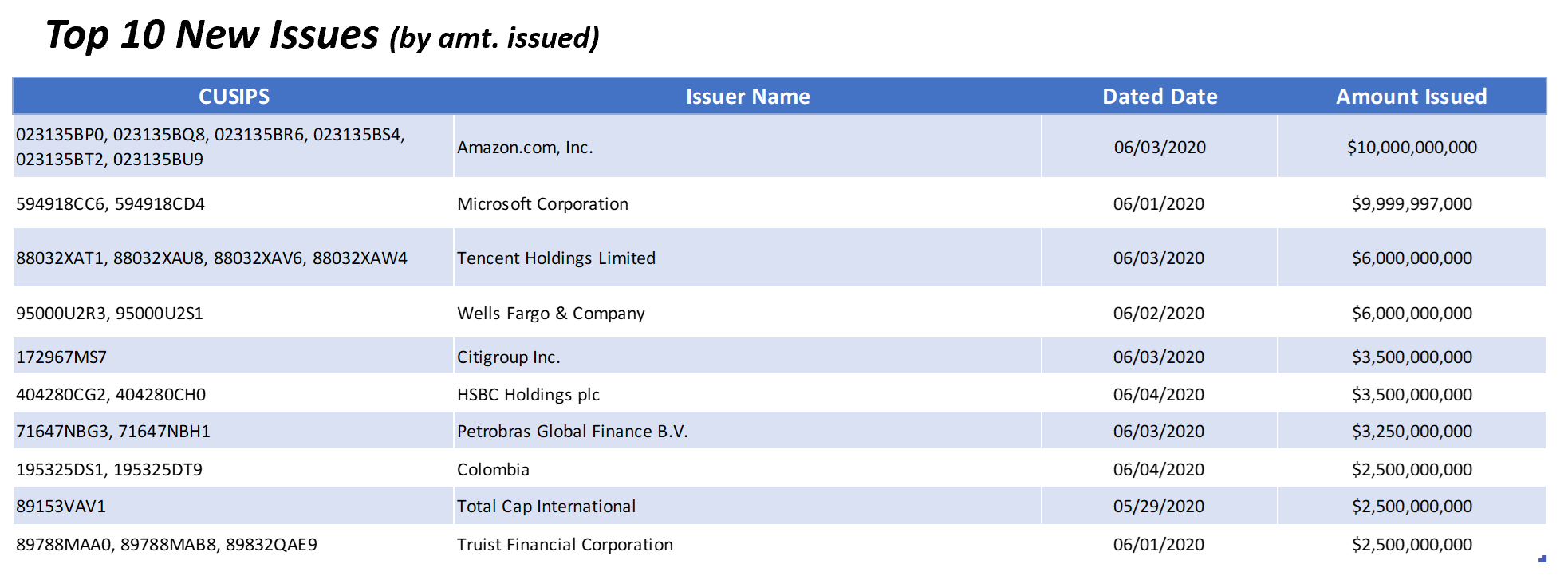

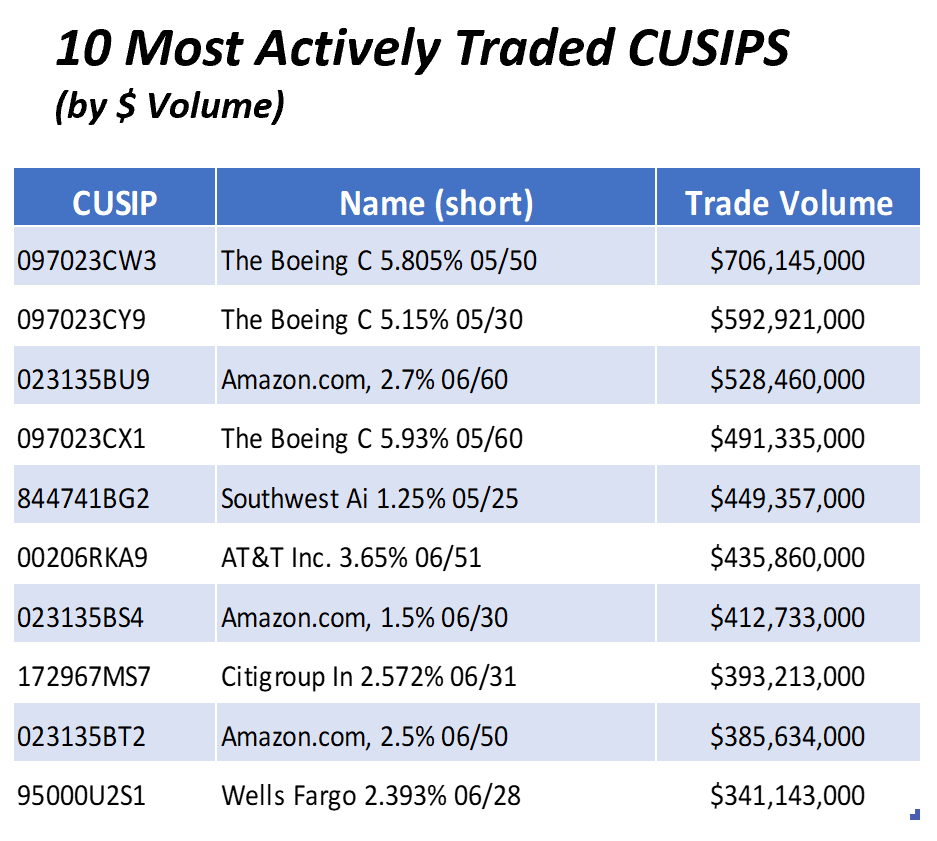

The new issue market remained hot as ~155bn was issued in IG and ~50bn in high yield for the week from 05/27-06/03. The investment grade space was once again led by financials at ~55bn for the week, also driving single A- as the most issued rating. The main drivers in the high yield space was in retail as Macy’s issued a 5-year bond at 8.375%.

Municipal bonds recover from COVID but face the same old problems

As munis recover from the deep impact of COVID, the quandary of pension liabilities will take the stage once again. States are not permitted to declare bankruptcy, but as seen in 2013 in Detroit, cities can declare bankruptcy. As municipal budgets have already been stretched, the pension obligations to public employees will be important for investors. Around 40 general obligation bonds with ties to specific cities were issued a rating change last week with approximately 85% having a maturity of 10+ years. Investors have a lot to swallow as they assess the damage of COVID and the remaining reality of pension obligations.

The EU increases bond-buying, however, lacks progress in trade talks

The EU increased its pandemic purchase program by 600b EUR and now stands at 1.35 trillion EUR. The ECB also confirmed that bond buying will be extended to at least June 2021 and pledged to reinvest proceeds from maturing bonds until the end of 2022. Though the interest rate remain unchanged, the EU is ready to adjust as inflation hit a four-year low of 0.1% in May. In addition to the EU, Germany surprised to the upside for their stimulus package by 30% and agreed on a 130 bn EUR stimulus package for the country. The key factors to the terms included funds for 5G mobile networks and higher rebates for electric cars.

All eyes will be in UK Prime Minister Boris Johnson who is expected to meet European Commission President Ursula von der Leyen and EU Council President Charles Michel on June 19 for the EU Summit. As trade talks between the two ended, both sides still appear to be far apart on major topics.

Key indicators for the week ahead

This week will be highlighted by core CPI and Fed Chairman Jerome Powell’s press conference on Wednesday, June 10. The market will digest the speech and look to the initial jobless claims for the first week in June, which will be released on Thursday, June 11. With markets approaching being flat on the year, investors will be keen to see the Fed’s next steps and additional positive economic indicators.

YTD Returns as of EOD Friday 06/05/2020

US Barclays Agg +4.95%, 1.43% yield, -140 bps excess return

US Barclays Corp +3.536%, 2.31% yield, -476 bps excess return

UST 10yr 0..90% yield, -102 bps

S&P 500 3,194, -1.14%

DJIA 27,111, -5.00%

OIL (WTI) $38.97, -36.33%

Gold 1,688, +11.09%

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.