The Fixed Income Brief: The Calm Before the Storm

Fixed Income Trivia Time: How many Federal Reserve banks are there and how many vote at a time?

This week was relatively boring for bond investors, marked mostly from the continued volatility in the equity market and the political fallout of Supreme Court Justice Ginsburg’s passing. Rates remained range bound as economic indicators paint the picture of a gradual global recovery. Michigan Consumer Confidence came in better than expected at the end of the prior week; housing sales continue to show that sector humming along on the back of historically low rates and the significant migration of individuals from cities to lower populated areas of the country while they are able to work from home. In Europe, the data was mixed as PMI manufacturing surprised to the upside, but service fell way short of expectations, showing how travel and entertainment continues to be hurt during this pandemic.

COVID-19 is still rightly the main focus of investors and as cases pick up in various pockets around the world, economic expectations get questioned and reassessed. This week the focus was on the U.K. as it reverts to much stricter standards that had been relaxed through the end of the summer.

Next week brings us to another monthly jobs report with an expected +850k jobs to be added and an unemployment rate of 8.2% (down slightly from the 8.4% for August). In addition to this key number, we will get an additional check on where the consumer stands on Tuesday with the CB Consumer confidence number. It looks like the politics of a stimulus bill have been tabled over the Supreme Court nominee. Investors may not feel the immediate impact of this given all of the past stimulus initiatives, but in order to keep economic activity going in the medium-term, something has to be done or the markets could sour much quicker than government officials may like.

Rest in peace Ruth Bader Ginsburg.

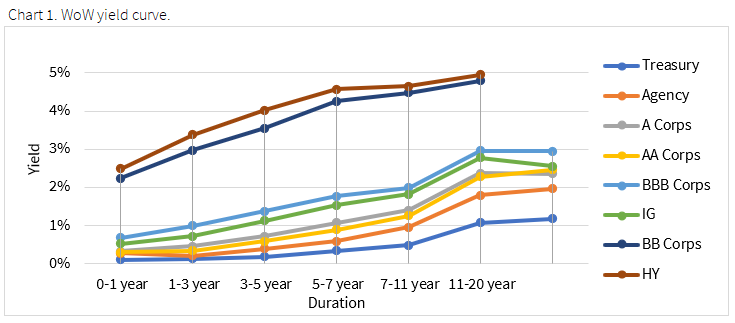

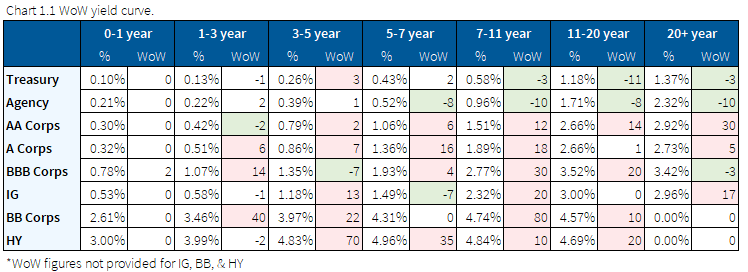

Yield curve flattened on disappointing economic data

Weak jobless claims and mixed manufacturing data led to a slight move to safety, specifically targeting the long end of the curve. The 30-year moved ~5bps tighter on the week, while the 2-year remained flat.

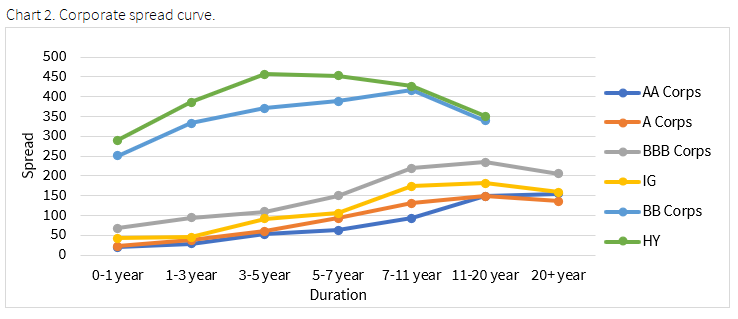

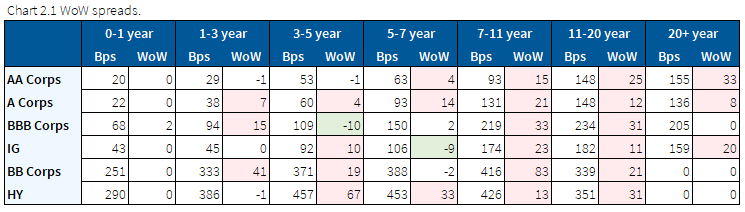

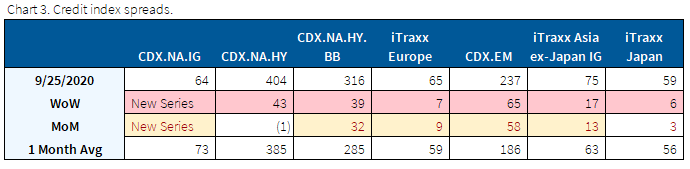

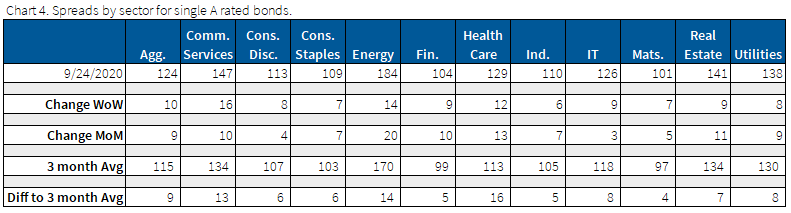

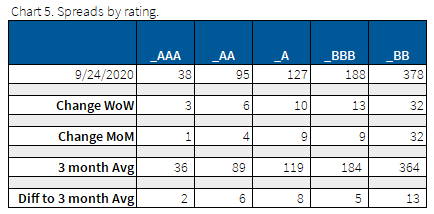

Spreads move wider on the week, testing wides from July

All major credit indices traded wider on the week as CDX IG rolled to a new series. Investors are digesting worse-than-expected economic data, concerns around the economic outlook driven from the absence of further fiscal stimulus, and election jitters.

The energy sector continues to be the weakest performer in the space, as oil retracts on weak demand after a small increase due to the hurricanes. Idiosyncratic names that underperformed the broader IG and HY markets include Nabors, Royal Caribbean, Carnival, Occidental Petroleum, and Macy’s. Outperformers were driven by Hovnanian, Avon Products, and JetBlue.

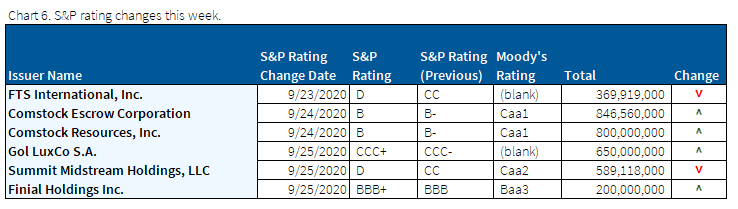

Upgrades outweighs downgrades amidst broader credit deterioration

This week, S&P’s upgrades outweighs downgrades during a week of broader credit deterioration. However, there were no significant trends amongst the ratings changes.

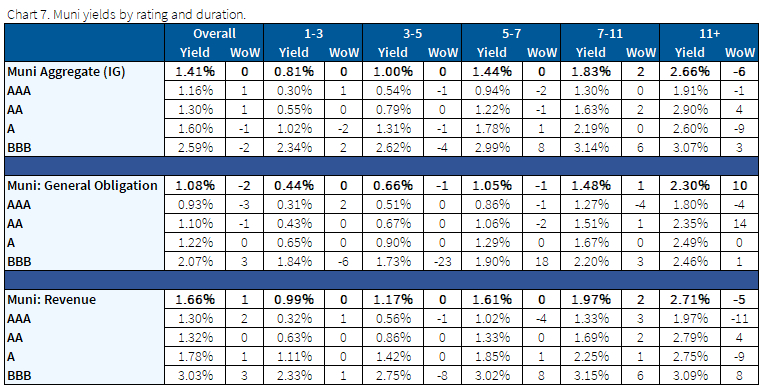

Munis underperform slightly in the face of increased supply

Municipal bonds underperformed Treasuries this past week on the back of continued supply. In taking advantage of the Fed-induced lower rates, state and local governments have sold ~$315bn in long-term debt in 2020 thus far and remain on pace for the third largest issuance year ever, with the biggest year of issuance being $424bn sold in 2016.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This will create for anomalies in the data but aligns with our effort to reflect actual market conditions.

Fixed Income Trivia Time Answer: 12 total; 5 vote at a time on a rotational basis

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.