The Fixed Income Brief: Are Re-Opening Rollbacks Impacting the Economic Rebound?

Jobless claims rose for the first time since the initial claims at the beginning of the pandemic. Labor data showed jobless claims rose to 1.42 million from 1.30 million last week. A key takeaway from today’s release is that the reopening rollback is definitely impacting the economic rebound. The improvement we observed appears to have stalled. Several regions of the U.S. appear to be backtracking in terms of COVID-19 containment and labor market performance. After months of steady declines, jobless claims remain stuck at over 2 million filings per week.

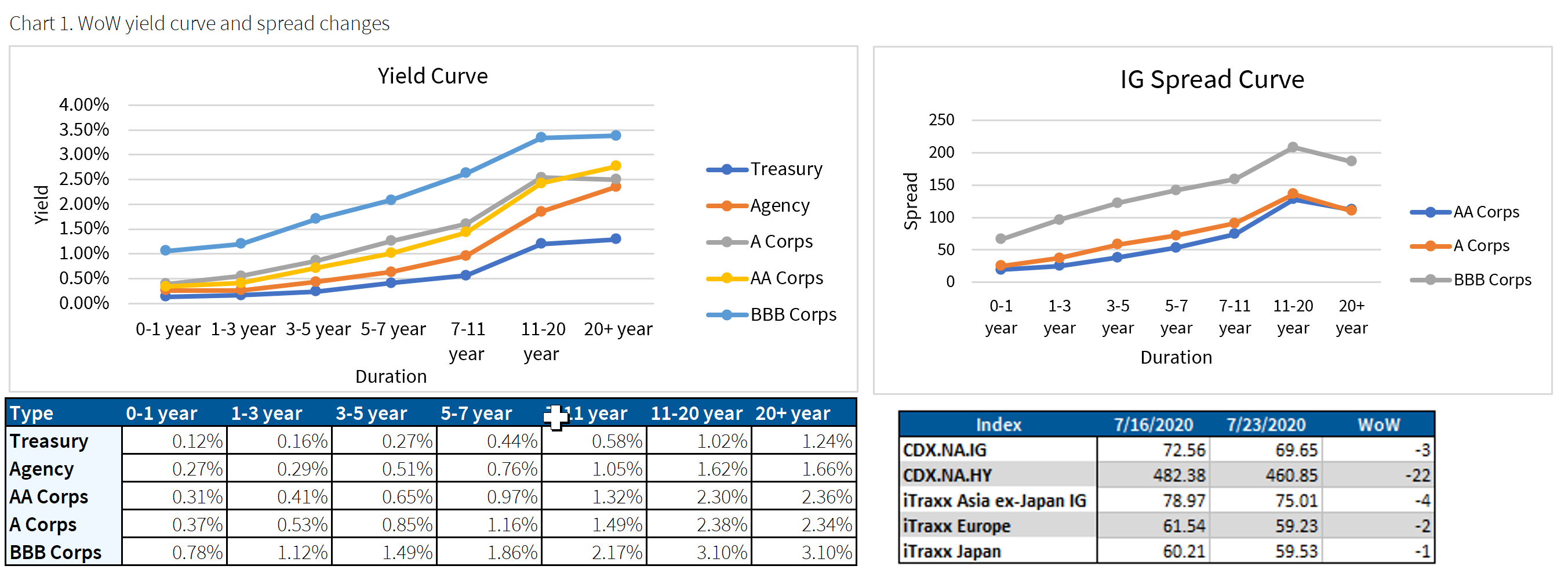

Spreads keep tightening across major indices

Spreads across major indices are tighter week over week and the Treasury yield curve modestly flattened. Moody’s wrote this week that “an unfolding global recession will rein in Treasury bond yields. As long as the global economy operates below trend, 1.25% (currently at 1.02%) will serve as the upper bound for the 10-year Treasury yield.”

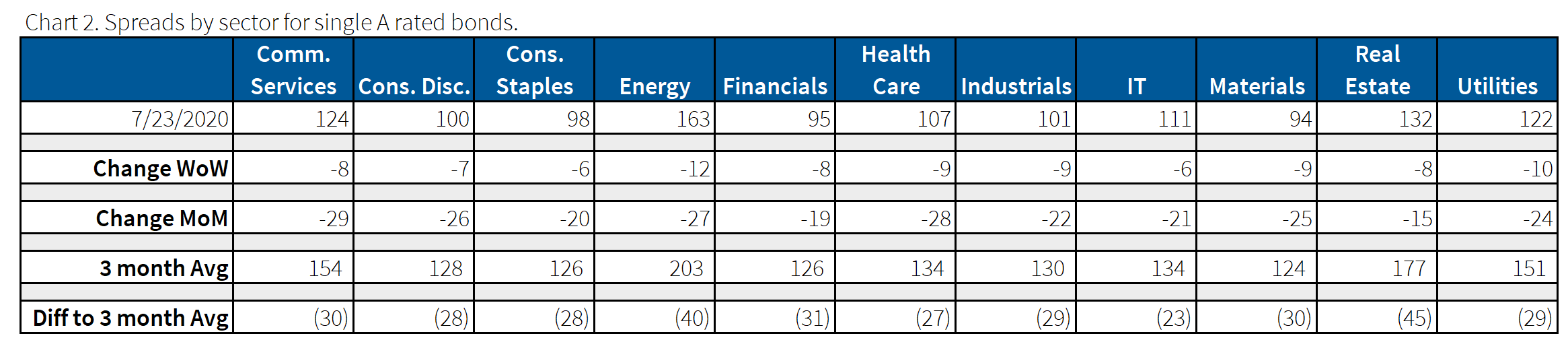

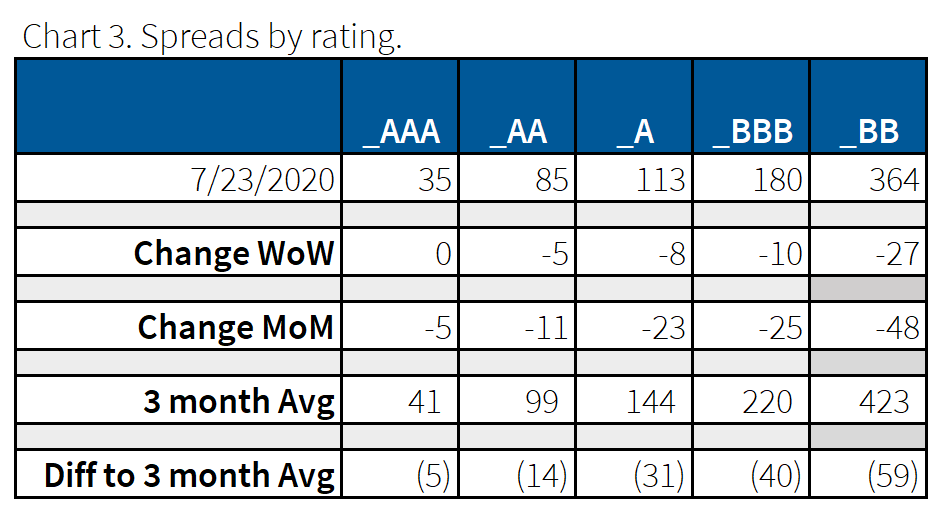

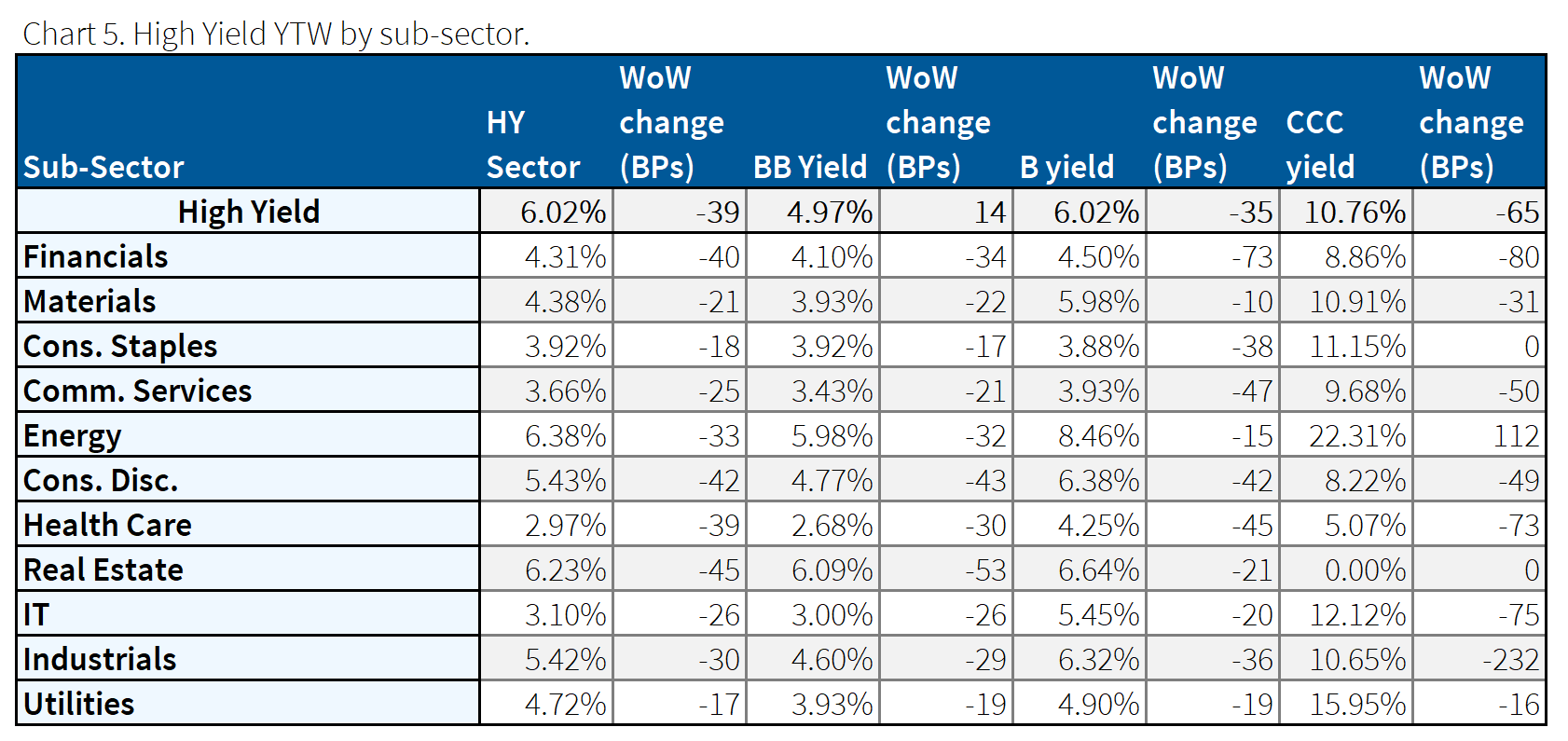

Energy and healthcare lead the pack this week

Until COVID-19 risks fade, substantially wider credit spreads remain a possibility, however spreads continue to tighten WoW. Energy was the big winner this week as of 07.23.2020, but Friday brought lower oil prices off rising tensions between the US and China. Over the past month, healthcare has been one of the largest winners (tightening 28bps), led by single A names.

As compared to the same time periods in 2019, the worldwide issuance of investment grade corporate bonds grew by 69% in Q2 and by 40% in the first half. 1H20’s issuance of IG bonds from U.S. corporate borrowers skyrocketed by 92.5% to $1.036 trillion. That said, new issuance is expected to be down in July compared to 2019, which is highlighted by a muted new issuance calendar this week.

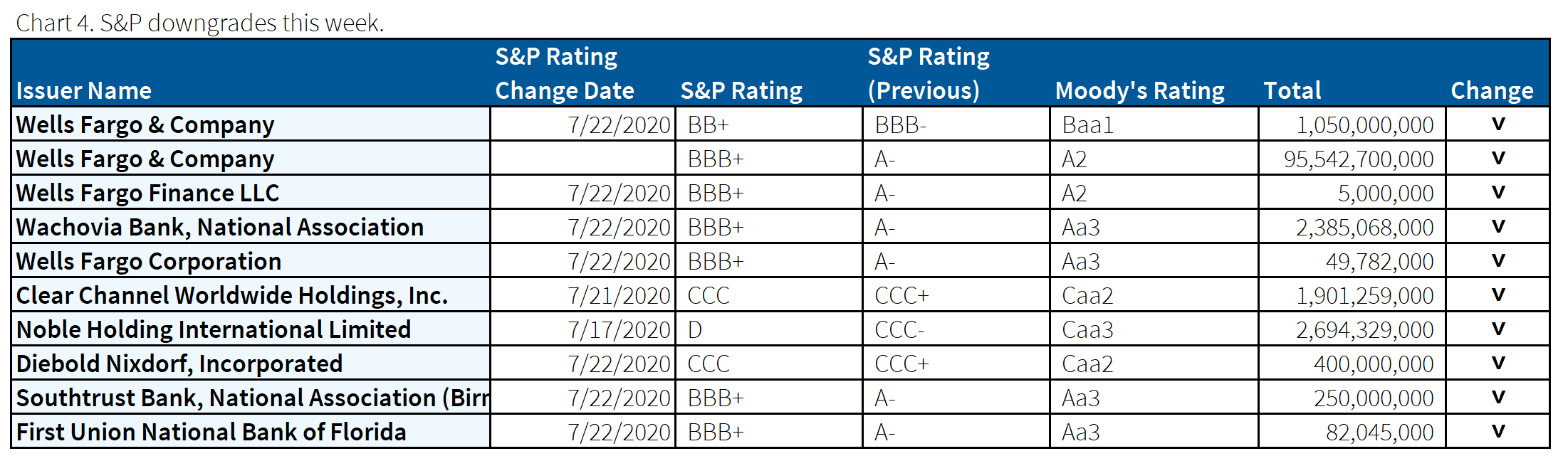

Only downgrades issued by S&P this week

U.S. rating change activity worsened last week, with S&P only issuing downgrades. The most notable is the downgrade of Wells Fargo to BBB+, who has struggled from having a less robust investment bank trading arm.

Default rates for high yield continue to soar

June 2020’s U.S. high yield default rate of 7.3% was up from June 2019’s 3.3% and Moody’s expects on average the default rate to jump to 12.3% by 2021’s first quarter. For July, spreads continue to tighten across the spectrum on the back of higher oil prices and a pick-up in the real estate market.

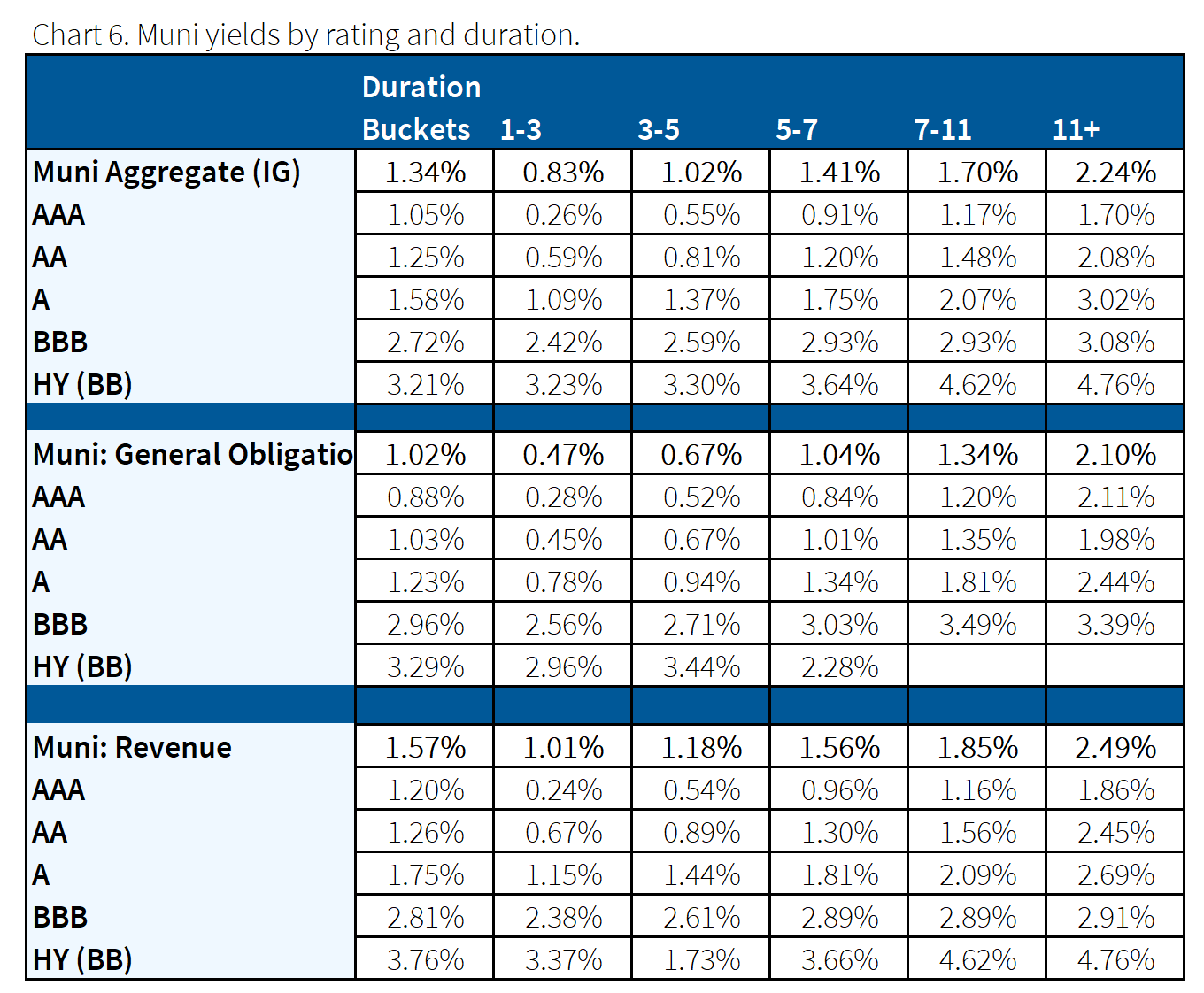

Muni market also sees yields tightening and default rates increasing

The GOP still hasn’t agreed on the components of its stimulus bill and it will be interesting to see how the muni market is affected by the proposed bill, which is most likely to come out Monday. Initially it looks like the GOP will propose ~$1 trillion in stimulus geared towards unemployment benefits. Yields continued to tighten this week, but default rates are starting to increase, specifically in the high-yield space.

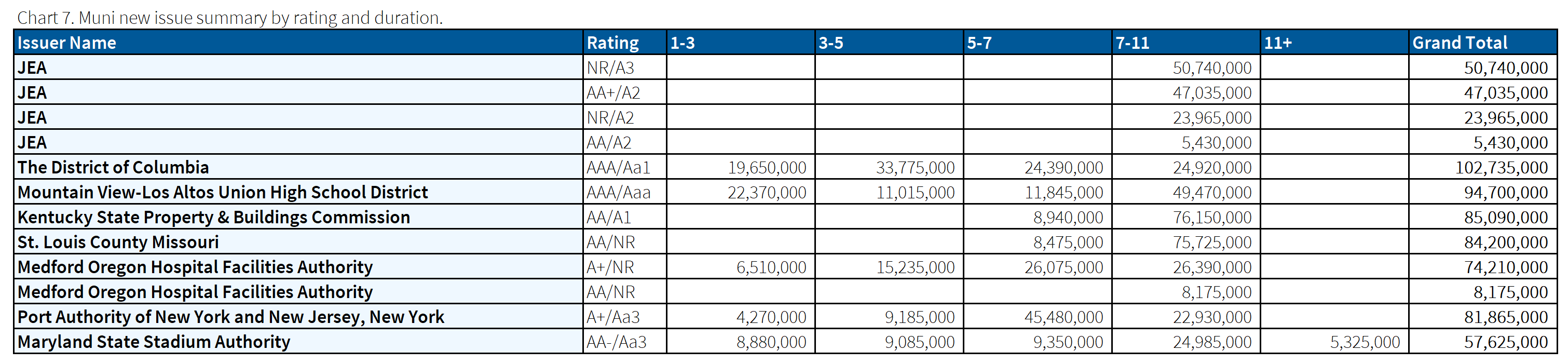

District of Columbia leads new muni issuance

Net issuance is flat on the year, and this week we highlight the District of Columbia new issuance, which tapped four tenors of the market.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.