The Fixed Income Brief: Pow Pow(ell)

Fixed Income Trivia Time:

The first credit agency was created due to what financial crisis?

Next week, the Fed is expected to accelerate the tapering of its bond-buying program, likely reducing its purchases by $30bn a month rather than $15bn that was originally assumed. This in turn has fixed income investors pricing in a more aggressive Fed, with the expected likelihood of a hike moved forward to May 2022.

Gauging the progress in the recovery of jobs since the pandemic is critical now as the Federal Reserve changes gears on its ultra-easy monetary policy and prepares its first normalization steps after more than a year and a half of unprecedented accommodation. Initial filings for unemployment insurance totaled +184k for the week, the lowest going back to September 6th, 1969. The total number of people receiving benefits under all programs dropped as well, lower by -350k to 1.95mil, about ~10x that level a year ago. At the moment, it is less clear the recovery is fully complete as the above trend in claims contradicts the weaker-than-expected monthly payroll numbers from last week that disappointed markets. November’s non-farm payroll showed hiring growth of just 210,000, well under expectations even with the unemployment rate sliding to 4.2%. There is a chance Powell and the Fed use the full lack of clarity to not be overly hawkish, but the market certainly will expect a significant change in the committee’s tone.

The more pressing driver for Fed action remains the stubbornly high inflation figures. Friday’s CPI release supports recent market sentiment that the Fed will now need to take more aggressive steps to combat price increases. U.S. November Core CPI increased +0.5% MoM and +4.9% YoY as expected by the market. The headline YoY figure is up +6.8%, up from +6.2% in October, and slightly higher on the MoM basis than the market expected, the highest level since the summer of 1982.

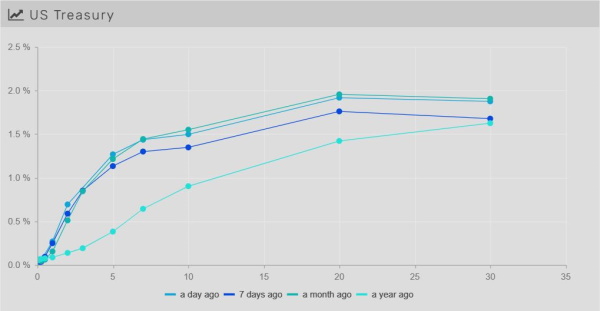

Volatility picks up ahead of Fed meeting, rates end higher WoW

The benchmark 10yr U.S. Treasury bond traded in a ~15bps range this week, ending higher towards the top of the recent range at 1.48%. The 2yr note linked more closely to Fed policy moved higher by +13bps on an intraday basis, but closed off the high to end +7bps WoW at 0.66%. The price action in Treasuries overall was driven by a shift in the expected chances of seeing the first hike in May vs. July as the Fed is set to meet next week to lay out their strategy to unwind open market purchases.

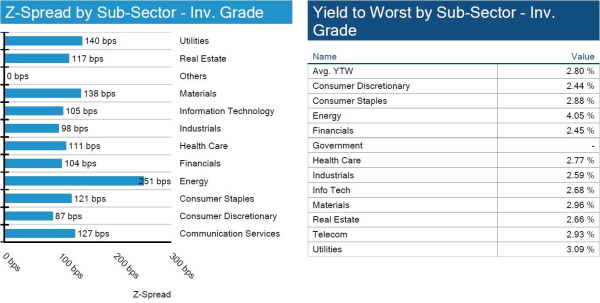

IG spreads continue to reflect future concerns from Fed action

Credit spreads move wider as expectations settle in for more widening. Yields on the long end are lower and real bond yields are expected to move higher.

High yield continues to outperform IG

HY is outperforming IG MTD by ~140bps bringing the YTD difference to 348bps. The driver continues to be a reduction of the overall default rate to pre-pandemic lows.

Portion of Qualcomm’s debt sees upgrade

Qualcomm was upgraded to single-A on broadening their revenue stream and increasing growth trajectory.

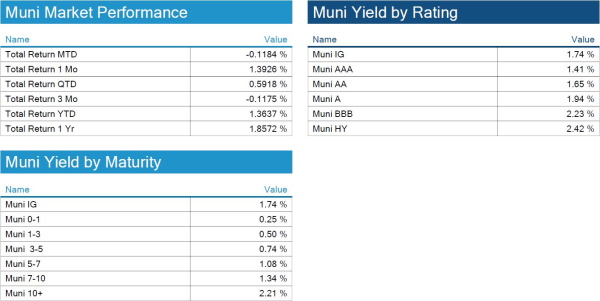

Munis close out an already busy year on a high (supply) note

The municipal bond market is headed out of 2021 with a rush of issuance, but still not enough to keep up with the insatiable amount of demand. Issuance is expected to be about $21bn over the next 30 days, with most of that front-loaded to the next two weeks, led by a $4.2bn CA tobacco deal. The current visible supply is the highest the market has had YTD, which is typical given syndicate desks are trying to get things out the door before year-end, but also ahead of an expected more aggressive Fed in 2022. The issuance will be welcome by the market though as investor cash balances are heavy at the moment. Is it enough supply to cheapen muni spreads? Check back next week for the answer.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, December 9, 2021.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

The financial crisis of 1837. Lewis Tappan established the first agency in 1841

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.