The Fixed Income Brief: Powell’s Frustration

Fixed Income Trivia Time:

How much money will be spent on Halloween this year?

The Fed’s key inflation measure reached its highest level since May 1991 as supply chain disruptions and extraordinarily high demand extended ongoing price pressures; core PCE increased +0.3% MoM and was up +3.6% YoY. These figures reflect the inflationary pressures Federal Reserve Chairman Jerome Powell said he finds “frustrating” earlier this week. On a headline basis, which consumers feel in more real-time, prices increased +0.4% MoM and +4.3% YoY, the highest since January 1991. Most of the recent price pressure is coming from energy prices, showing a +24.9% increase, and a +2.8% increase in food prices. Despite the FOMC communication around inflation being transitory, several additional supply-side and shipping gauges remain under pressure for the foreseeable future without a near-term fix to many of the shortfalls. The extent of the European gas shortage will also be hard to predict, as storms and supply issues can take time to resolve. Consequently, the ECB has maintained its passive, “do nothing” position regarding near-term inflationary pressures, but only time will tell what the lasting impact of these price impacts will have on secondary goods and services. It is a difficult point in the cycle for central banks as they need to plan ahead, yet consumers are feeling the real impacts today.

Further detail around the economic releases this week showed goods prices increase by +5.5% while services are still trending back from pandemic lows to an increase of +3.6%. Despite headline wage pressures being noted everywhere, personal income only increased +0.2% MoM, indicative that real income is falling as inflation rises. Spending accelerated 0.8%, slightly above the 0.7% forecast. Personal savings totaled $1.71 trillion, running at a 9.4% rate vs. 10.1% in July, and far lower than the peak savings rate of 33.8% in April 2020 during the early days of the pandemic. The ISM Manufacturing Index for September came in at 61.1 vs. 59.5 expected; the survey also showed prices rising with roughly 80% of respondents reporting further price increases slightly higher than August’s reading and supporting the ongoing supply-side struggles companies are facing. University of Michigan’s Consumer Sentiment Index improved to 72.8 vs. 70.8 last month and was above the 71.0 estimate.

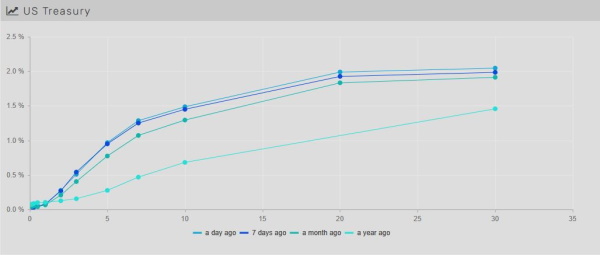

Treasury yields experience a wild ride as inflationary pressures raise risk

Treasury yields rose through most of the week on the back of inflationary pressures and acceptance that the Fed has reached escape velocity for removing some of the extreme monetary stimulus it continues to provide. Despite all of the inflationary news and expectation of monetary stimulus beginning to unwind, rates ultimately reversed course which saw the U.S. 10yr yield almost unchanged WoW. Midweek rates reach levels not seen since early June as investors have conceded to the fact that the largest buyer of bonds was about to being to taper in November. Rates are now in the middle of their 6-month average and it feels like events over the next few weeks can send rates much higher or lower at this point.

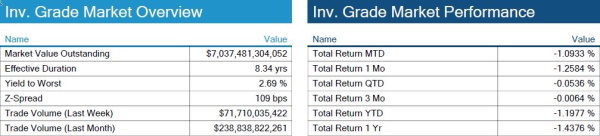

IG credit spreads widen on tumultuous week in DC

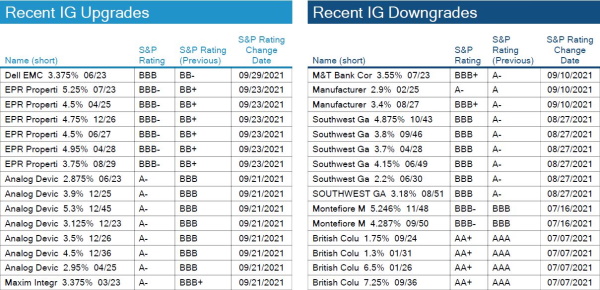

While not too many rating change movements this week, we see some of Dell’s credit move on earnings.

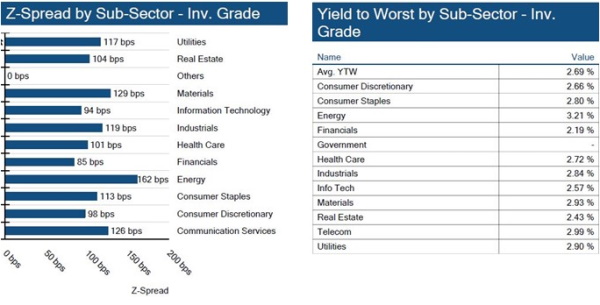

Yields elevated driven mostly by rates

Yields are up in HY driven by rates and political uncertainty. Elevated oil prices have also helped energy names. Idiosyncratic loser on the week is Rite Aid, which posted a $100mm.

Quiet week for S&P credit changes

“We are very pleased to have secured investment-grade ratings from both S&P and Moody’s, which reflects the strength of our experiential property portfolio,” stated Greg Silvers, president and CEO of EPR Properties.

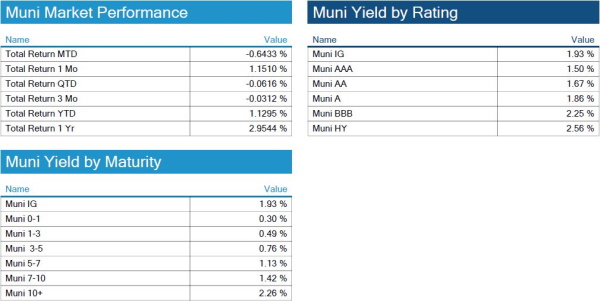

Munis underperform U.S. Treasuries as visible supply increases

The move higher in rates in September caused municipal bond total returns to go negative over the quarter. Despite tight technicals (demand outweighing supply), yields underperformed Treasuries and steepened further this week. More liquid AAA and AA rated bonds sold off more than lower-rated bonds as investors are still comfortable holding on to positions that provide additional spread given the strong fundamental backdrop that is still in place. Future visible supply is ~$16.6bn, up from the weekly average of $12.5bn for the year and highest since early June, which will likely put pressure on munis over the near term. California sold ~$1.8bn HY tobacco securities this week, the largest taxable tobacco deal ever and the largest taxable deal since 2018.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, September 30, 2021.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

The National Retail Federation (NRF) expects consumers to spend a record amount of $10.1 billion for Halloween this year, according to a survey done by Prosper Insights & Analytics.

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.