The Fixed Income Brief: Back to School as Fed Takes Lessons From Past Mistakes

Fixed Income Trivia Time:

How much back-to-school spending is estimated for 2021?

Communication around tapering seems like threading a needle in the dark given how the market hangs on to every word from Federal Reserve Chairman Jerome Powell and the FOMC. This week we got a glimpse into what they are thinking from Fed minutes of their July 27-28th meeting where, “most participants noted that, provided that the economy was to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year.” As expected, Fed members kept the discussion at a high level, with no discussion around exact timing and pace taking place. In the end, it really boils down to the August and September jobs data and any significant impact on economic activity from the Delta variant. As we highlighted last week, there’s already been a hit to consumer confidence and usually, that becomes a leading indicator in terms of consumer spending. From reading through the minutes there seem to be two camps well established at this point. The first group wants to start to wind down and conclude the Fed’s open market purchases sooner rather than later in order to reload some dry powder so the Fed can act if a future shock takes place. The second group really wants to see better progress on the jobs front in an aim to return to pre-pandemic levels. The one common thread for all members seems to be consensus about inflation, that it remains too high but that it will ultimately come back down to the Fed’s 2% target over time – they just don’t all agree on when this will occur and whether to wait for it to happen naturally.

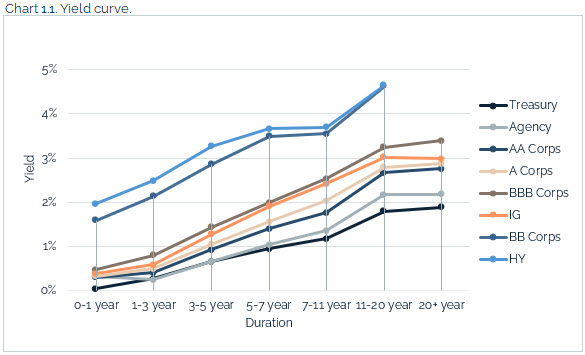

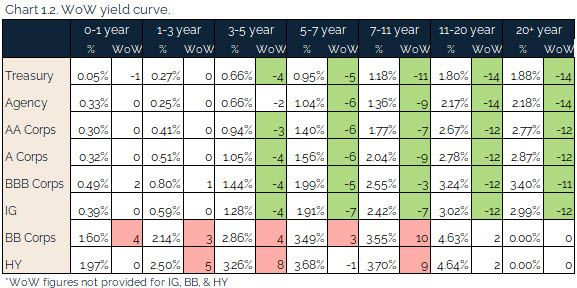

U.S. rates settle lower this week, now in the middle of their monthly range

U.S. rates benefited from a flight to quality on the back of investors moving up their expectations around the start of the Fed’s taper announcement. The 10-year Treasury yield has traded in a narrow range this week and 2s-10s spread remains ~+100bps, well off the peak at the end of Q1 around +160bps, and continuing the curve flattening that has been in place since early June.

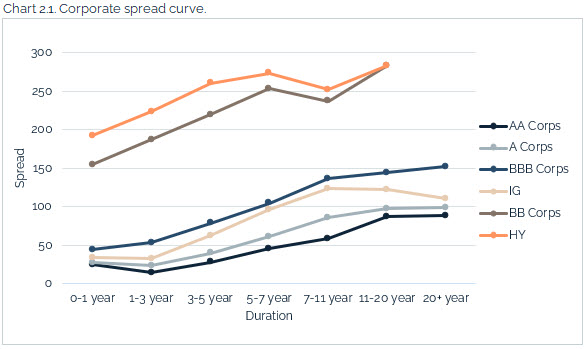

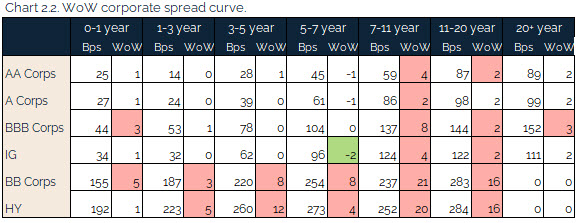

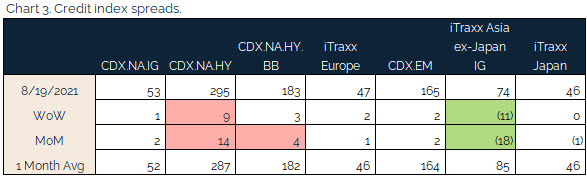

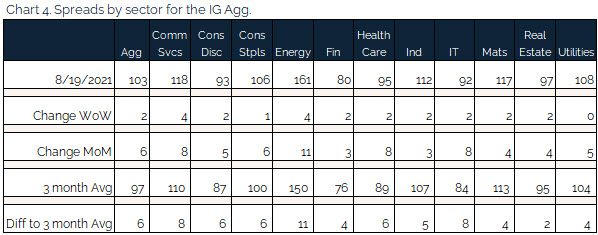

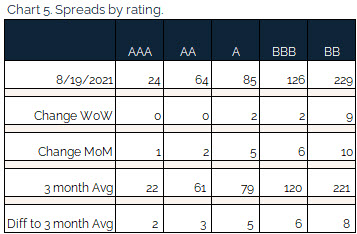

IG remains stable, HY drifting slightly wider; Asia ex-Japan continues to outperform

U.S. IG remains stable as investors contemplate the Fed’s next move, with HY investors feeling less confident given global growth concerns on the back of the Delta variant spread.

Recent spread widening has spreads trading above their respective 3-month averages. Energy remains the worst-performing sector on the back of recent oil price pullback and trades roughly 1.3x cheaper to the next closest sector.

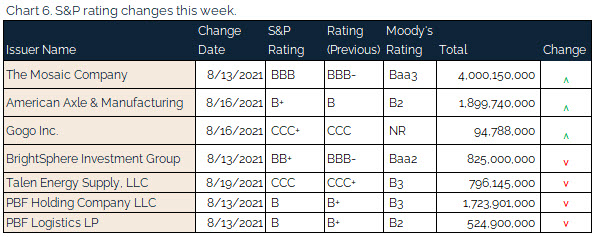

Mosaic upgraded by S&P

S&P upgraded Mosaic to BBB from BBB- with a stable outlook as a key producer and marketer of concentrated phosphate and potash crop nutrients for the global agriculture industry.

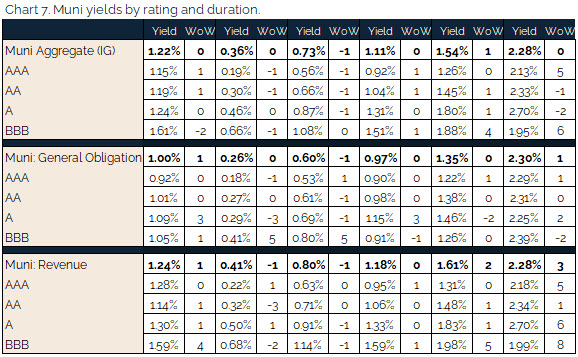

Munis yields little changed WoW

Muni yields didn’t change much this week with a decent visible calendar picking up to $13.9bn, but hearing deals are well oversubscribed as demand for tax-exempt bonds remains heavily intact. There still remain big question marks around the need for states to issue much going forward given the large cash inflows from The American Rescue plan that is providing $350bn allocated for state and local governments.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, August 19, 2021.

Fixed Income Trivia Time:

$848.9bn

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.