The Fixed Income Brief: Markets Put the Fed on the Clock

Fixed Income Trivia Time:

What body of water does the Colorado River empty into?

Federal Reserve Chairman Powell’s Jackson Hole speech on August 27th may or may not reveal the game plan for the much anticipated unwind of open market purchases. It seems the market believes it is far more likely that the Fed continues to be patient, allowing for the next two jobs reports to confirm the full extent of the jobs’ recovery and wage growth. The market fully anticipates tapering by the end of this year with most assuming it proceeds at a “normal clip” of reducing purchases at a rate of ~$15bn/month, likely wrapping up by June of 2022. The risks are slightly leaning towards a faster taper, hence the recent recovery in long-dated Treasury yields off of their lows, but this is predicated on the August and September jobs figures being strong and the Delta variant not throwing a wrench in the works.

Speaking of the Delta variant, the economic data we received this week reminded markets how quickly sentiment can change when dealing with a pandemic. It is never great to invest based on one data point, especially one as fickle as consumer sentiment, but the August Eurozone ZEW economic sentiment survey showed confidence fell off a cliff (42.7 vs. 61.2 in July) to its lowest point since last November. A key driver was the German measure which dropped -16 pts to 40.4, roughly half the sentiment indicator showed in June (79.8) and the lowest point since last October. Same goes for the U.S. as both the Michigan Consumer Expectations and Sentiment surveys dropped significantly -14 pts (65.2) and -11 pts (70.2) respectively; with markets anticipating an uptick, this was a significant data point that reversed the recent rise in yields.

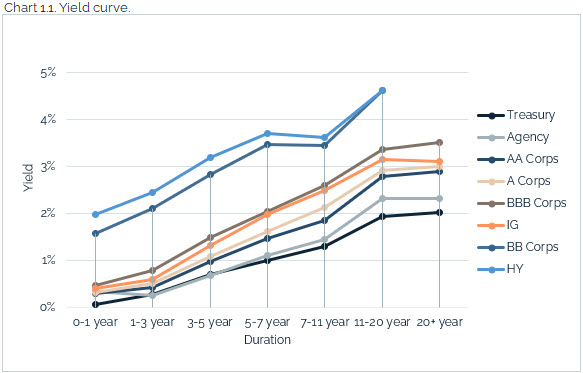

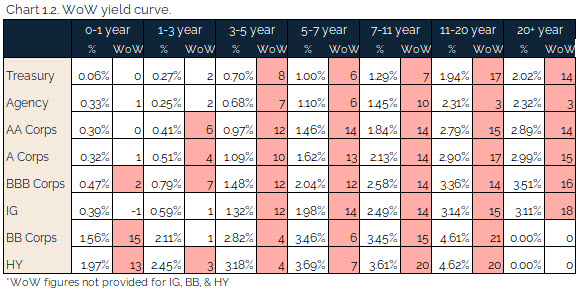

U.S. rates rise on Fed taper, solid earnings, and infrastructure bill

The 10-year Treasury had risen for seven consecutive days leading up to the auction on Wednesday, which came at 1.34% with a strong bid-to-cover ratio of 2.65 and most interest being seen from foreign investors (indirects). The 30-year auction came at 2.04% versus 2.00% in July.

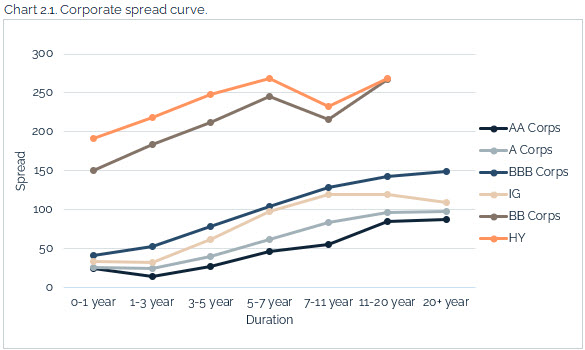

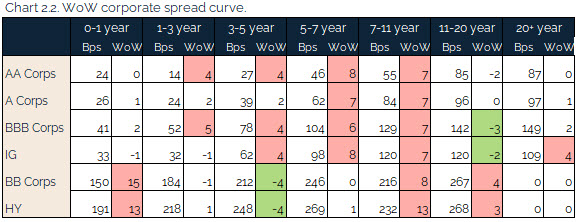

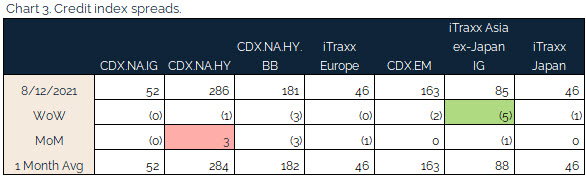

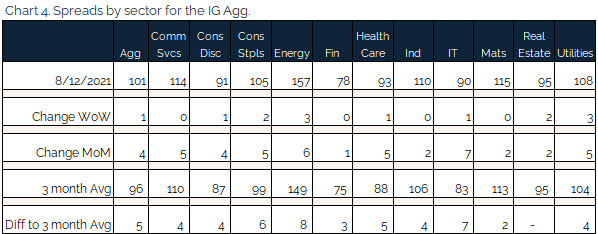

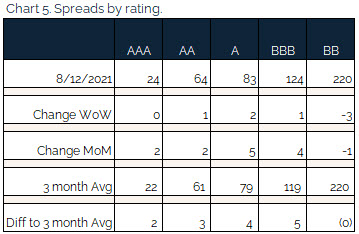

Quiet week in spreads as we remain close to tights

No significant credit moves this week as it will be tough to go too much tighter from here without an additional catalyst.

Idiosyncratic drivers in credit spread tightening were Carnival Corp, Royal Caribbean, JPM, and NRG Energy. Names wider on the week include Tenet Healthcare (new CEO) and Expedia (Q2 earnings).

No credit changes by S&P

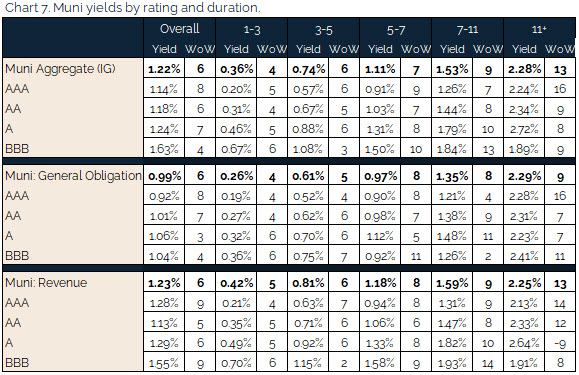

Munis yields rise, welcome sign as fundamentals set to improve on the back of the infrastructure bill

Muni yields were up this week on the back of higher rates despite the continued strong demand from investors. The slight increase in yields across the curve are making the sector look a bit less expensive even as credit fundamentals are expected to be significantly bolstered if the infrastructure bill passes. This bill will greatly support state and local government finances with cash injections meaning ultimately less supply. On the demand front, the picture is expected to improve even further as investors will seek more tax-exempt income as taxes are meant to rise as well. S&P released a recent report stating that it had completed 80 public finance downgrades which is the lowest quarterly total since 2009. At the same time, upgrades outnumbered downgrades for the first time since the 1st quarter of 2020 and this trend seems likely to stay in place for the foreseeable future.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, August 12, 2021.

Fixed Income Trivia Time:

Gulf of California

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.