The Fixed Income Brief: Summer Daze

Guest economic analysis and muni commentary: David Loesch

Fixed Income Trivia Time:

Where was the U.S. 10yr at when the original Top Gun movie was released in June 1986?

As temperatures heat up around the Northern hemisphere and parents and kids prepare for their first ‘normal’ summer in 3 years, fixed income investors are plotting their course through rate hikes, inflation data, and the inevitable growth slowdown. Successful navigation of these big three economic fronts is unfortunately predicated on a lesser-known actor in Mr. Putin. All these risk factors have kept rates capped and with their recent trading range as investors look for cover from various risks and flows out of riskier securities (think equities and crypto).

Today’s non-farm payroll report came in stronger than expected (+390k vs +325k exp.) but was the slowest jobs growth since April 2021. The unemployment rate remained at 3.6% and is a good number for the Fed to proceed with their expected +50bps rate hike in two weeks. Progress on the inflation front was also noticed as average hourly earnings MoM came below expectations (+0.3 vs. +0.4 exp.) and ticked down to 5.2% YoY from 5.5% YoY from the prior release.

One maneuver taxable investors have executed is the addition of municipal debt – not for the traditional tax-exempt income, but for the diversification and fundamentals.

Fortunately for our readers, we have partnered with DRL Group’s David Loesch to provide his recent insights into the municipal market:

- Heading into Memorial Day weekend the muni market turned on a dime; outflows slowed to $1B in the week ended 5/25, the smallest withdrawal since March. The muni market staged the biggest rally in two years fueling optimism that pricing may be close to a bottom. The selling pressures of the last five months have disappeared. Buyers have also been drawn to munis by cheaper evaluations ahead of a calendar period when the asset class tends to benefit from investors looking to reinvest principal and interest payments.

- As mentioned last week, visible supply going into the summer will remain light, as it began the week at $8.8B, well below the average of $11.6B. This point should help our markets as we move through the week and month.

- According to the prior report, the Fed Beige Book will likely conclude that economic activity is expanding moderately. The last Beige Book figures pointed to accelerating consumer demand, solid manufacturing activity, and strong demand for housing. This fact suggests that Fed Funds Rates will be moving up over the near term. Inflationary pressures have shown tentative signs of abating; however, this should not change the course of the 50bps move this month. With our markets seeming like they are on the rebound, it will be interesting to see how the month of June finishes.

- Chatter on a U.S. recession increased volume last week as new home sales plunged. The Fed indicated that it needed “clear and convincing” evidence of a decline in inflation before considering any policy changes. I do not think we will see any changes until this year’s winter.

- Municipalities plan to sell $9.36b of bonds and notes this month. In the next 30 days, redemptions and maturities will total $27.8b, compared with $22.8b a week ago. According to Bloomberg News, institutional investors offered $1.47b for sale through bid-wanted lists in the last session, up 25% from $1.17b the previous day.

- According to Invesco, municipal bond prices have sunken so low that they are starting to lure crossover buyers who don’t typically purchase this debt. Firms like banks or insurers are looking to take advantage of the market’s low default rates and strong fundamentals, says Stephanie Larosiliere, Senior Muni Strategist at Invesco. “Since this started, it has all felt very mind-boggling because muni fundamentals have never been better,” she said on Bloomberg Television. “From a historical perspective, munis have just gotten extremely cheap.”

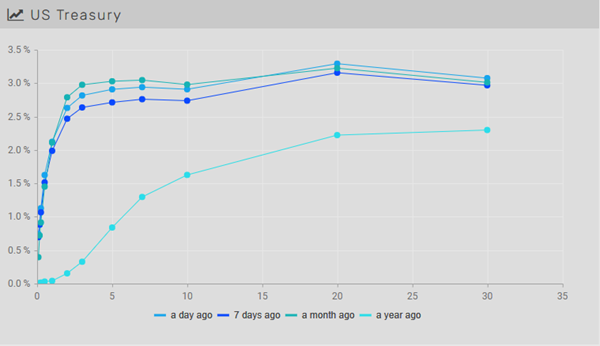

Rates end the week at their highs as the NFP clears the way for Fed hike

After trending down leading in to Memorial Day weekend on the back of risk aversion, rates pushed higher throughout the week across the curve and ended near their highs on the back of the non-farm payroll release. The U.S. 5yr & 10yr traded pretty much in lockstep and increased the most (+25bps) as the 2yr and 30yr maturities were both up ~ +20bps. The slight steepening of the belly of the curve leaves the 2-10s spread ~+4bps higher at +25bps.

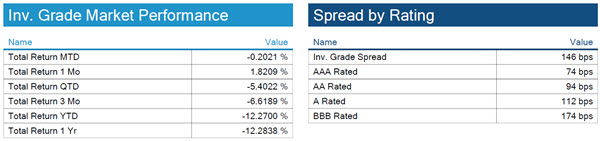

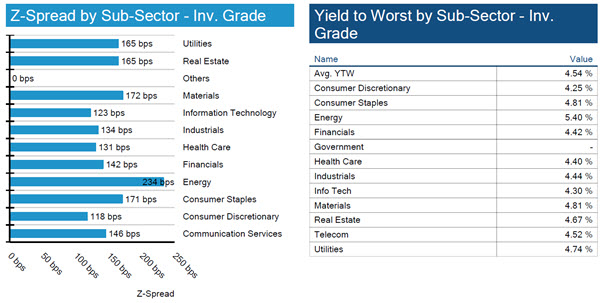

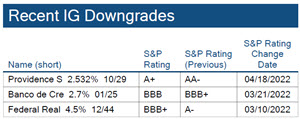

IG spreads tighten on mini rally

Spreads tightened -6bps as the market reacted bullishly to a better supply chain and a potential pause in rate hikes (short lived after Brainard) in September. CPI will be the big driver next week of rates and outlook for monetary policy as the jobs report exceeded expectations.

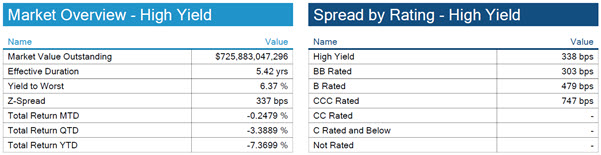

High yield modestly tighter

High yield corporate bonds tightened ~20bps, but still hover around two-year wides. Default rates continue to lower MoM after some volatility and increased proability of a recession.

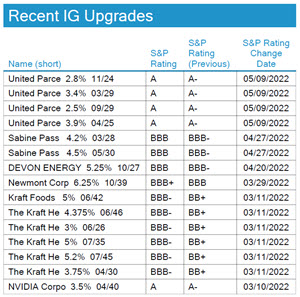

No major S&P rating changes

S&P did not change its rating outlook on any IG issuers this week.

Pivot in muni land highlighted by significant demand

More about David Loesch, Owner of DRL Group

David has specialized in fixed income trading since 1994, covering all areas of the bond markets. David deals with everything from defaulted issues to AAA bonds to tax-exempt and taxable bonds. David is constantly collaborating with other dealers in the marketplace bidding on issues and making markets in certain securities. David not only deals with the large institutional accounts on fixed income transactions, but also has a large retail client base that gives a good insight on what the markets are looking for and how the retail world looks at current events in addition to how it affects them on a personal level.

Explore the DRL Group, specialists in bonds, primarily tax-free bonds.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, June 2, 2022.

Fixed Income Trivia Time:

7.8%

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.