The Fixed Income Brief: Yields At a Crossroad

Fixed Income Trivia Time:

Who was the President the last time the U.S. public debt was at zero and what year was it?

Where do we go from here? The recent rally in Treasuries surprised a number of fixed income investors who continue to think long rates, given robust growth forecasts, should increase from here. The shift in the recent range on the 10-year Treasury from mid-1.60% to mid-1.50% has not been a huge surprise, but many believe this is simply a holding pattern before a liftoff to an inevitable +1.75% and beyond, and a continuation of a steepening yield curve. The main wildcard here is global growth – which has been substantially hindered by additional virus caseloads and slower vaccination rollouts. For U.S. Treasuries, the global picture is equally important in determining the path of interest rates; the trajectory of the pandemic in large countries like Brazil and India will hold just as much weight for determining the path of rates as U.S. economic data. Overall, the endless number of forces pushing and pulling U.S. interest rates will give in one direction or another, though most investors are betting on higher from here it may not take much to continue to see rates surprise on the downside. Stay tuned.

Data this week was constructively led by another set of decent Markit PMI prints with composites showing continued improvement in both the U.S. and Europe, 62.2 vs 59.7 (March) and 53.7 vs 53.2, respectively. European activity continues to be led by German industrials with the country’s manufacturing PMI remaining elevated at 66.4. The European service sector eked into expansion territory (50.3) for the first time since August 2020, as Europe has been slower to rebound due to virus concerns and a slower vaccination rollout. The U.S. Services PMI for April (63.1) shows a much more sustained recovery is in place with nearly half of the population receiving their first vaccination and activity overall picking up significantly. Weekly initial jobless claims (547k) came in better than expected (617k) and remained below 600k for the second week in a row. Despite the improvement seen getting folks to work, the claims data remains more than double their pre-pandemic levels.

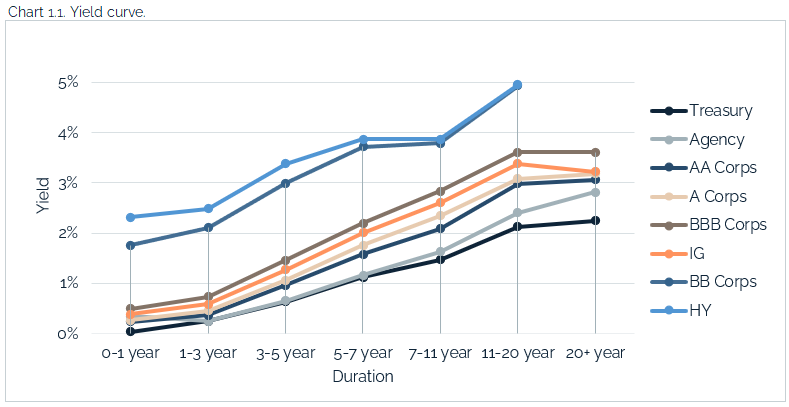

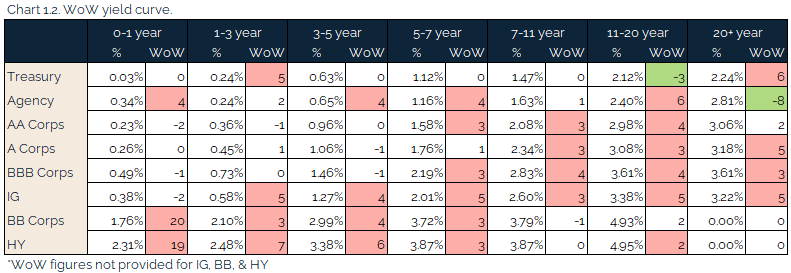

Rates finish relatively unchanged on the week, despite mid-week rally

A risk pullback combined with investors reassessing the growth forecast beyond the initial jolt of fiscal stimulus checks has the 10-year Treasury yield (1.58%) sitting in the middle of the recent established range. Beyond virus concerns, the next move should depend on the Fed’s ability to jawbone investors into believing they will stay the course in providing continuous support through $120bn open market purchases and keeping rates near zero.

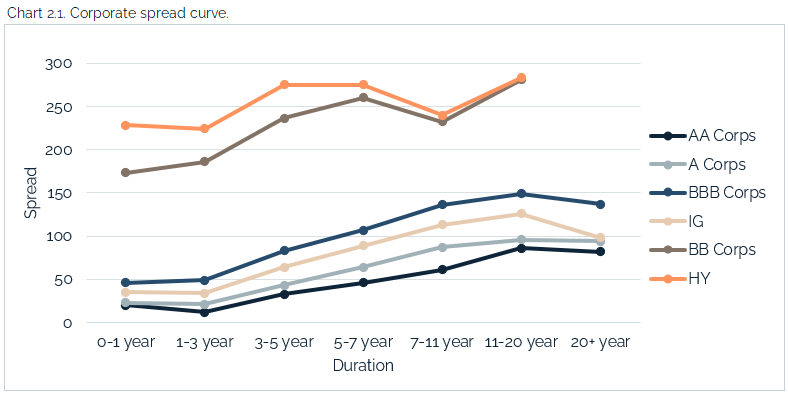

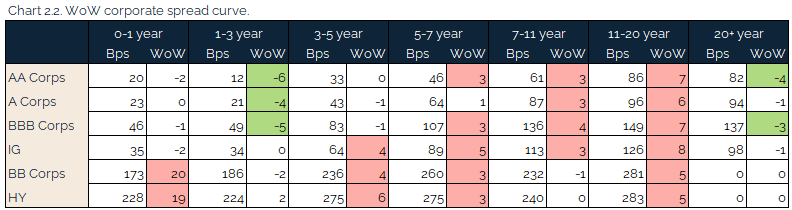

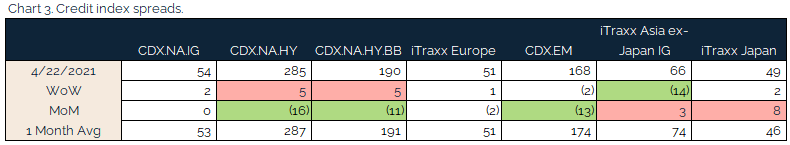

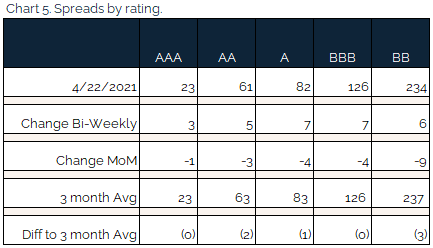

Spreads widen across the board

Both credit spreads and credit index spreads sold off this week while they still hover around decade tights. On the month, IG is flat while high yield is ~20bps tighter. Expectations for additional new issuance should come on the back of low yields.

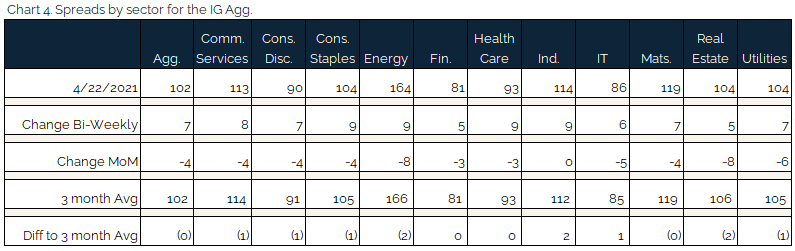

All sectors sell off as the Agg ends 7bps wider. Idiosyncratic winners came on the back of strong earnings for JPM and BOA, which drove their spreads tighter. Losers for the week were the beaten-up cruise line industry, as Carnival and Royal Caribbean see spread widening of +30bps.

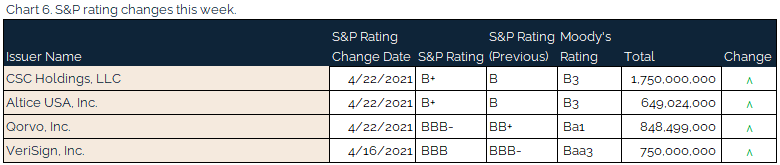

All upgrades, but nothing of substance

CSC Holdings, the cable and telecommunications company, saw a slight upgrade in its debt from B to B+.

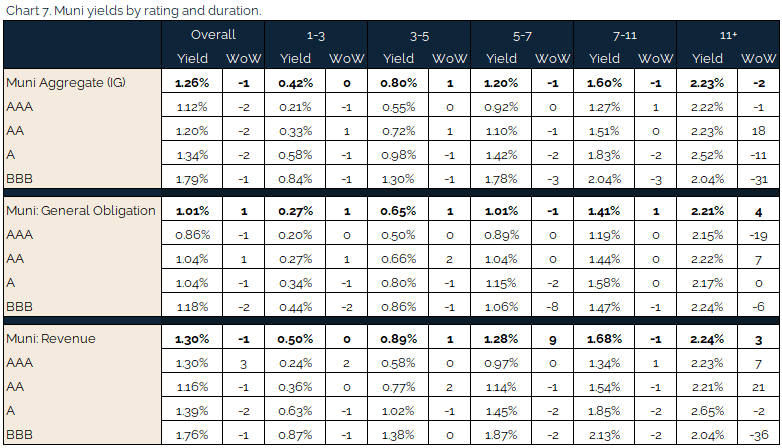

Muni yields relatively flat WoW as demand remains intact

Muni yields changed little over the week despite continued signs of demand outstripping supply. Fund flows continue to be strong and last week alone saw an additional +$2.25bn. New deals continue to be oversubscribed with investors extending into lower-quality credits as the fundamental picture in municipals continues to see improvements with better than expected tax receipts and federal government support.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Apr. 22, 2021.

Fixed Income Trivia Time Answer: President Andrew Jackson in January 1835

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.