The Fixed Income Brief: Powell and the Fed Continue to Provide Stimulus

Fixed Income Trivia Time: Over the past ~50 years, what is the percentage of notional value that has defaulted in muni bonds?

Another week of continued fixed income investor debates around when the Fed should take their foot off the gas. The market continues to point to higher prices in assets, commodities, and housing as a sign that it is time to start applying the brakes on the monetary stimulus that’s been provided to keep the market from a meltdown as the world plunged into a global pandemic. Fed Chairman Powell has a different idea in keeping the Fed engaged until the lowest parts of the economy begin to heal further after taking the brunt of this crisis. Powell stated, “I think it’s highly unlikely that we would raise rates anything like this year,” Powell told CBS 60 Minutes last Sunday evening. He continued, “I’m in a position to guarantee that the Fed will do everything we can to support the economy for as long as it takes to complete the recovery.” Powell has continuously stated that a ‘complete recovery’ means getting the unemployment rate back down to pre-pandemic levels with the attempt to lower the wealth gap and leave no person behind. The U.S. economy has recovered more than 13 million jobs since the depths of the pandemic, but there remains about 9 million more still looking to get back to work. In addressing the risks around inflation, Powell is confident the Fed can handle it once it appears, saying he would “like to see it on track to move moderately above 2% for some time. When we get that, that’s when we’ll raise rates.”

Keeping on the inflation theme, U.S. CPI data this week edged higher with the core MoM print +0.3% higher versus +0.2% expected and core YoY +1.6% versus +1.5% expected. These figures remain well below the Fed’s threshold of 2% and keeps them in the driver’s seat on keeping rates and open market purchases steady. Additional data showed positive impacts of the recovery as core retail sales, initial jobless claims, and regional manufacturing surveys all beat expectations significantly. The volatile core retail sales numbers saw an immediate boost from March stimulus checks, boosting the MoM rate to +8.4% versus +5.0 expected. On the jobs front, weekly jobless claims fell to 576k versus 700k expected, the lowest since March 19th, 2020 as the pandemic took hold. Finally, Michigan Consumer Expectations (79.7 vs 83.6) and Sentiment (86.5 vs 89.6) failed to surpass market expectations but remained at or above the levels from March’s print. Overall, the economic data continues to trend in the right direction with only the virus expected to be able to slow the current momentum down given all of the stimulus that’s baked into the economic cake at this point.

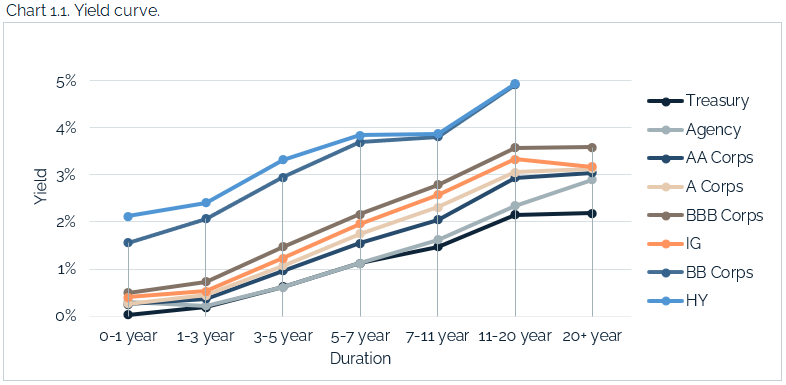

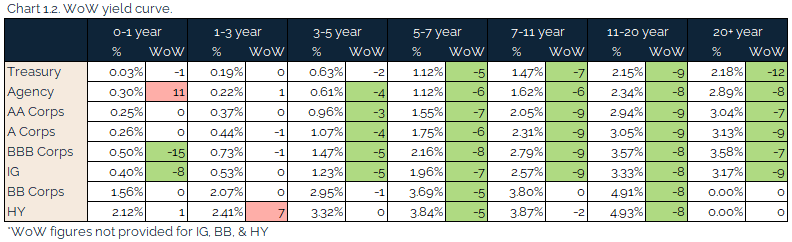

Rate volatility picks up, 10yr rates settle lower

On the back of the J&J vaccine being halted and the recommitment of the Fed to keep rates and bond purchases as-is for the remainder of 2021, long-dated Treasuries moved to their lowest point since early March – close to 1.50%. Given the front-end remains pegged, this saw the curve flatten substantially (-10bps), with 2-10s spread now hovering around +140bps. There was a 10-year auction early this week that printed at 1.68% versus the March auction that cleared at 1.52%.

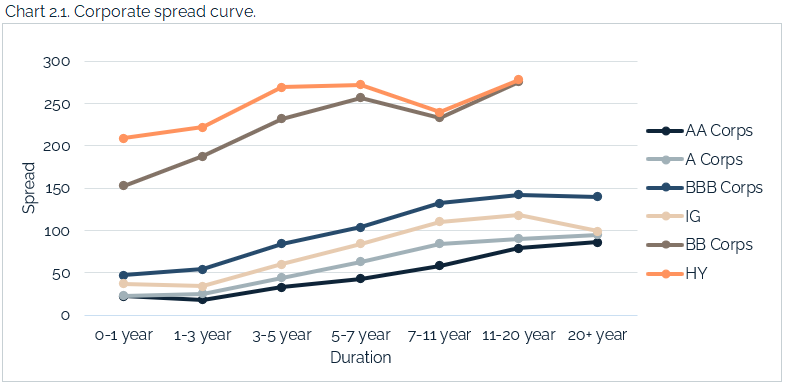

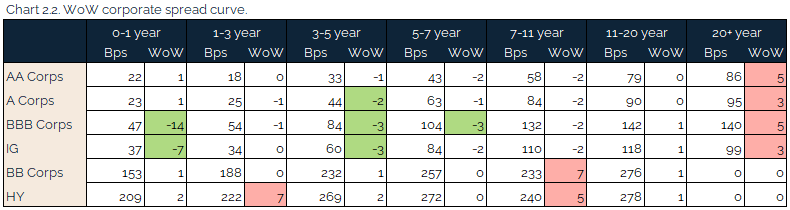

Spreads tighten across the board

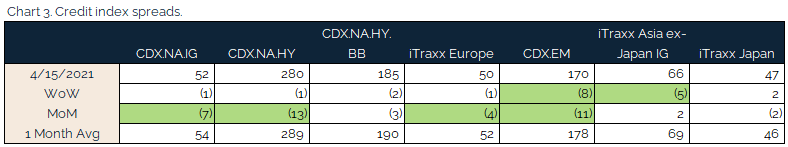

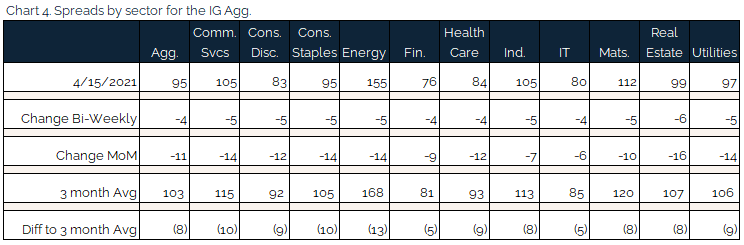

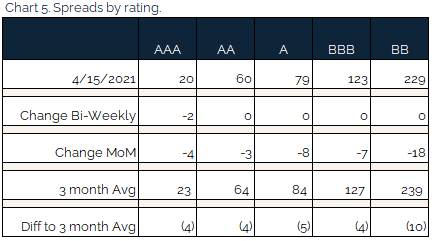

Both credit spreads and credit index spreads rally this week on the back of positive momentum from stimulus, earnings, and bullish COVID vaccinations in the U.S. Liquidity across credit markets have been strong and bank earnings have been extremely healthy (IG financials 4bps tighter on the week).

Real estate was the big winner this week (6bps tighter) as demand is back to levels not seen since 2007. Even in the face of lumber increases (+200% in prices), housing demand has created a single-family home shortage of 3.8mm according to Freddie Mac.

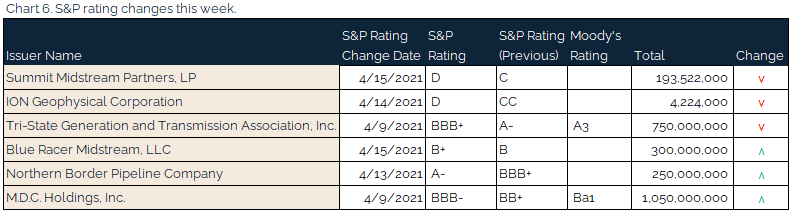

Builders see positive implied credit movement and MDC see portion of debt upgraded

MDC Holdings sees $1bn of debt outstanding as a rising star according to S&P. Three of their unsecured senior lien CUSIPs were upgraded to BBB-.

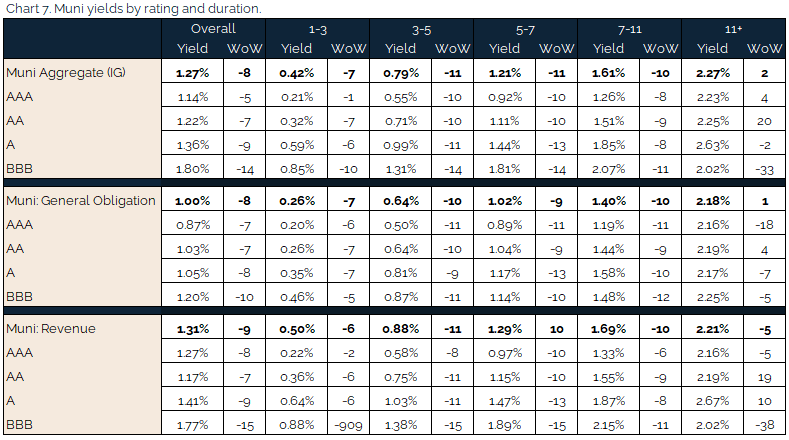

Muni yields lower as strategist champions the sector

Muni yields were lower across the curve as demand continues to outweigh supply with the trend seen to continue over the course of 2021. Reports of large surpluses at the state levels and further recovery of major cities’ unemployment rates will limit the amount of debt issuance as the pandemic fears of budget woes remain unfounded. This against a backdrop of an expected tax increase will keep money flowing into the sector for some time.

On the rating front, the State of New Jersey saw its credit rating raised by Moody’s to stable from negative on the back of stronger than anticipated tax collection revenues; this trend is expected to continue through 2022.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Apr. 15, 2021.

Fixed Income Trivia Time Answer: 0.1% or $72bn

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.