The Fixed Income Brief: Two Steps Forward, One Step Back

Fixed Income Trivia Time: What percentage of global trade passes through Suez Canal?

Balancing the reopening is hard. Reports indicate that COVID infections have picked up recently as economic activity has picked up. People are getting more comfortable traveling and meeting others in groups as the vaccinations increase and previously infection rates were lower. The problem is that with additional strains that are more contagious, the pattern of the economy moving forward seems more in tune with the Cha-Cha – two steps forward, one step back. The risk is that the variants are spreading and continue to cause the global economy to stutter rather than flow open, giving less certainty and, ultimately, weighing on consumer confidence. This is why the recent stimulus and the ongoing Fed support remain so important to the continued efforts on getting everything restarted and getting folks back to work.

One piece of data this week helping the Fed’s cause is that the key core PCE price index release shows inflation was only up +0.1% MoM. YoY it’s at +1.4%, below the +1.5% YoY expected and well below the Fed’s 2% median range. This gives the Fed slack in prolonging the support in place. European PMIs, which remain a leading indicator of economic activity, exceeded expectations with manufacturing (62.4 vs. 57.7 exp.) leading the way and services (48.8 vs. 46.0) clawing their way back towards growth territory (50.0). U.S. PMIs were also solid, coming in line with expectations and continuing to show good activity out of both the manufacturing (59.0) and services (60.0) sectors. Michigan Consumer Sentiment index came in at 84.9 vs. 83.6 expected and continues the recent rising trend. Lastly, weekly initial jobless claims were +684k and dipped below 700k for the first time since March 19th 2020 as the pandemic officially hit the U.S. economy.

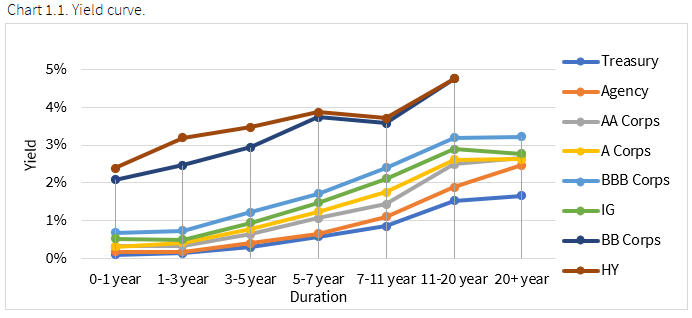

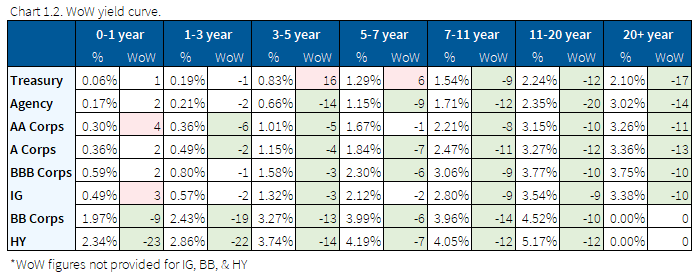

Rising rates trend pauses, 10yr down -10bps WoW

News on the virus front sent rates lower early in the week, with the 10yr Treasury yield down from 1.73% to 1.60% and settling by the end of the week around ~1.65%. The pause in the recent rise in yields has been a welcome sight for investors as worries on higher refinancing rates for corporates and higher mortgage rates tend to hurt profitability and slow the economy down.

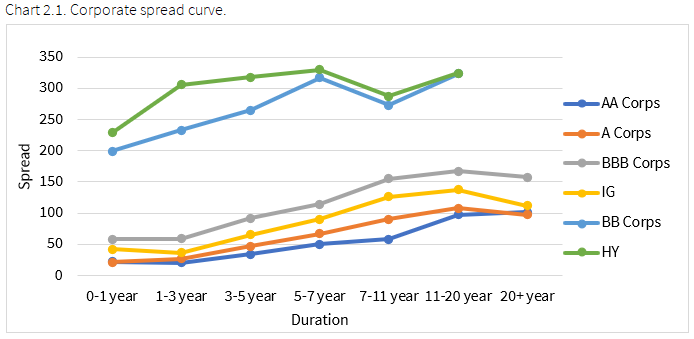

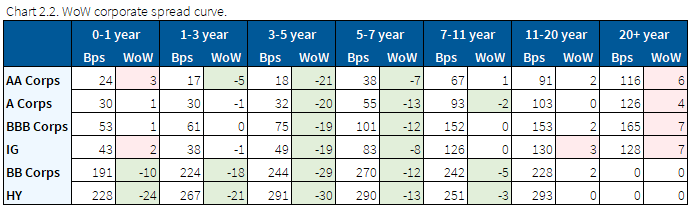

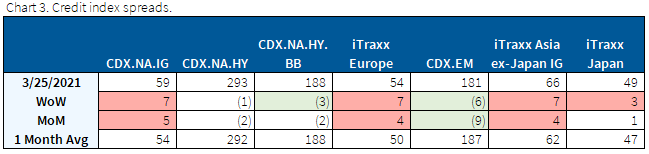

HY spreads tighten, while IG widens led by IT

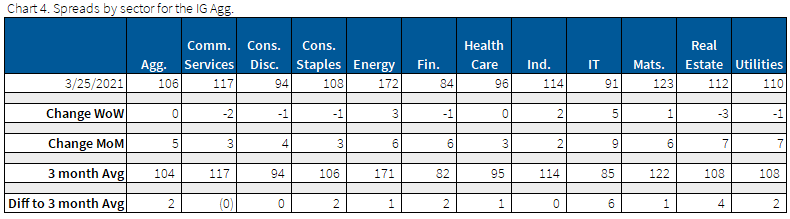

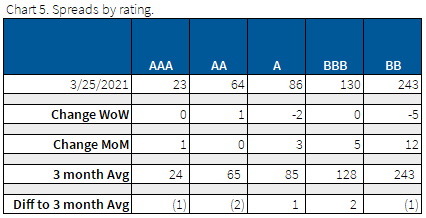

Investment grade credit widens this week and both IG credit indices and bond spreads are 5bps wider MoM. The flattening yield curve and lower rates have kept all-in yields lower and HY borrowers are welcoming the lower rates.

BB bond spreads close the week 5bps tighter, remaining relatively flat on the month. IG spreads are slightly wider and the IT sector has led the selloff since mid-March (10bps wider).

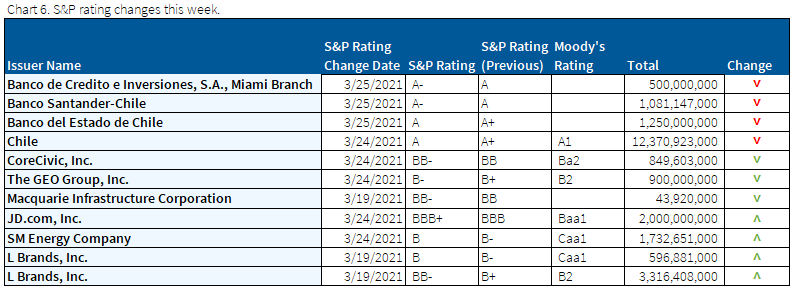

Chile gets downgraded by S&P

Meager growth in productivity and GDP coupled with social unrest and the pandemic led S&P to downgrade Chile to single A.

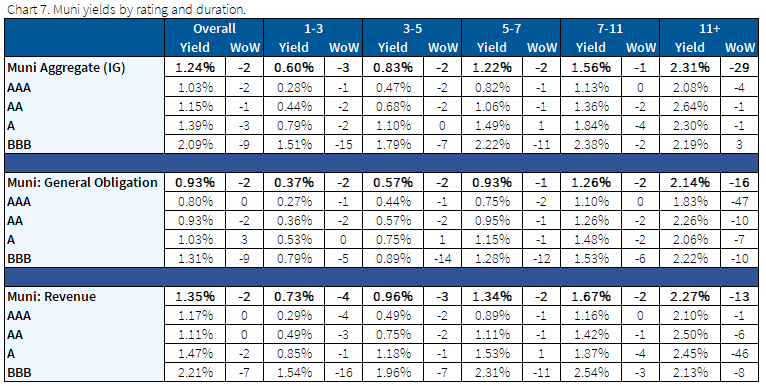

Munis facing variety of factors as new administration sets its course

Muni yields settled generally lower on the back of Treasury moves WoW, but the trend for lower yields is in place given supply / demand imbalances. Several key factors are in play that will determine the direction of munis over the next 3-6 months. The first is that states are expected to receive more cash ($513bn vs. $350bn originally expected) and this will have a direct impact on the need to issue more debt, starving an already robust muni appetite. Biden is also planning on raising taxes on individuals, which would increase the demand for tax-exempt income. Going against munis is the possible lifting of the $10k cap on SALT deductions, which if it happens, it would lower the demand for tax-exempt income. It may take some time before the tax changes would take place, but muni investors will be watching closely as these conversations unfold.

Biden may dust off an old playbook from the Obama Administration to help the government support infrastructure spending. Build America Bonds (BABs) were taxable municipal bonds that featured federal tax credits up to 35% or substantial subsidies for bondholders and state and local government bond issuers. They were introduced in 2009 as part of the American Recovery and Reinvestment Act (ARRA) to create jobs and stimulate the economy, and the BABs program expired in 2010. The impact could mean lower regular tax-exempt municipal bond issuance. The difference between BABs and traditional municipal bonds is that income generated from regular muni bonds is exempt from federal and some state taxes, whereas with BABs the interest income would be subject to tax at the federal level.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based off transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, Mar. 25, 2021.

Fixed Income Trivia Time Answer: 12%

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.