The Fixed Income Brief: All Rise

Fixed Income Trivia Time:

How many times has Saint Peter’s made the Men’s NCAA Tournament? How many total wins do they have?

—————–

This week, Fed Chairman Jerome Powell and other Fed speakers have reinforced their intention to be aggressive in quelling inflation. Powell reintroduced the idea of being more aggressive with a potential +50bps cut in one or more of the next upcoming meetings as one hike per meeting might not quick enough to get the Fed Funds Rate to where they want it. Powell stated, “If we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well.” Most Fed officials believe a neutral rate is near 2.5%, assuming annual inflation is 2%.

The takeaway here is that the steady course of hikes resulting in a year-end rate of 1.75% Powell outlined just a week and half ago seems unlikely now given estimates on future oil prices and still-unresolved supply chain issues and continued uncertainties from geopolitics and the virus. In the end, the market is beginning to price in the tightening persisting faster and well beyond 2% at this point. As expectations for an additional 4 hikes in 2023 would get us to a more restrictive monetary stance, all while allowing the Fed’s balance sheet to roll down without reinvestment, could leave rates well beyond the highs we experienced in 2018 (3.24% on U.S. 10s).

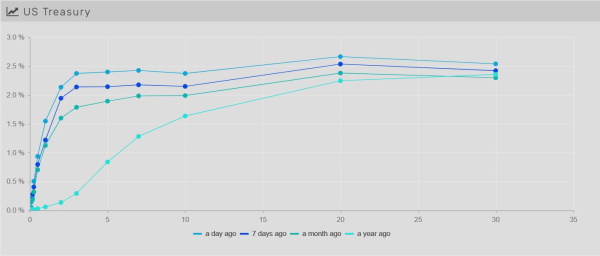

Rates push even higher on change in sentiment around Fed’s pace and destination

We sound like a broken record here as bond investors faced another volatile week with another move higher in yields and more flattening WoW. U.S. 5yr rose the most (+38bps) and now are trading +8bps higher than the 10yr (+30 bps). The 2-10s curve dipped below +20bps and remains the focus for a lot of investors.

If recent history is any guide, we expect the trend in rates ultimately going higher from here, and although a lot of market commentary is obsessing over an inverted yield curve, the clearing of geopolitical risks could see the long end move higher as the uncertainty of the Russia-Ukraine situation seems to have curbed the rise thus far. At the time of writing 2yr, 5yr, 10yr, and 30yr are 2.27%, 2.53%, 2.45%, and 2.60% respectively.

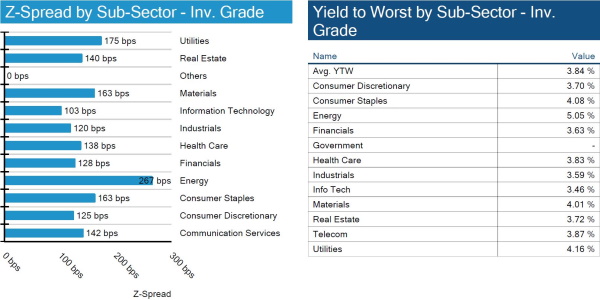

Spreads continue to widen week over week

Spreads widen +3-4 bps WoW as investors will turn to corporate earnings and the effect of inflation on the consumer. Corporate profit margins are a fundamental strength, and people are optimistic around earnings, but how fundamentals will support business investment if spreads continue to rise is yet to be seen.

High yield spreads modestly tighten from recent wides

HY spreads tightened -40bps this week as the spread between BB and BBB started to tighten. These recent spreads are still much wider than at the beginning of the year, and investors will keep an eye on issuance and default probabilities. For the first time since 2020, the implied default rate increased month over month.

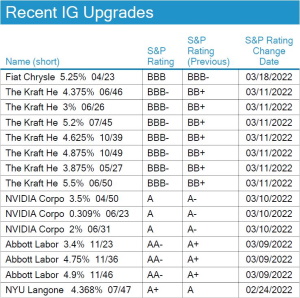

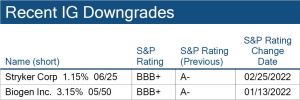

No S&P Credit changes on week

After a busy week last week, no changes to investment grade credit ratings.

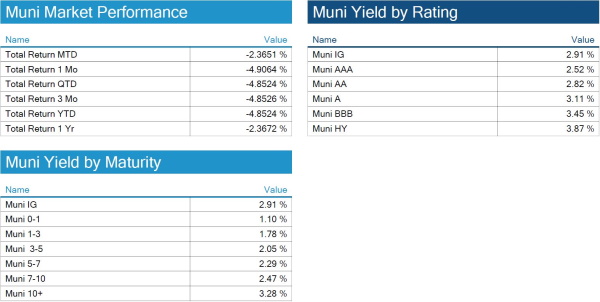

Municipal bond fund outflows to recover alongside growing comfort with Fed’s terminal rate

The municipal sector continues to face ongoing outflows, and Street research consensus is that this will continue through the remainder of Q1, but then start to recover as investors get comfortable at higher yields. From experience, they know they will need to slowly re-enter the bond market in advance of a wholesale shift in sentiment in order not to be left underinvested.

The recent past is still fresh in muni investors’ minds as they struggled to get funds put to work when bonds were in high demand. This will lead clients to want to get a head start on the herd as rates continue to rise and draw in more interest. Given the lack of expected supply in muni issuance the market “technicals” can change quickly and investors need to be in before to take advantage.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, March 24, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

2; 4

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.