The Fixed Income Brief: Powell vs. Putin

Fixed Income Trivia Time:

Who was the Fed president when Ukraine became its own country?

—————–

After the initial risk selloff and move lower in rates at the start of Russia’s attack on Ukraine, investors have taken a more sanguine view on the conflict as they wait and see how much further it might escalate. The reprice of March’s anticipated hike, limiting any chance of a +50bps move, has also bolstered risk markets, as the sense is the Fed will move forward with their stimulus unwind, but not as aggressively as perception was only a week ago. The economic data this week was heavy and on the positive end of expectations, bolstering the idea that the global economy is coming back with a strong base that can handle global central bank stimulus reductions going forward.

The U.S. holiday-shortened week saw strong economic indicators, with Friday’s Core PCE (+0.5% MoM and 5.2% YoY) being the main highlight. The numbers came in line with expectations, but the YoY print was the highest since 1983, and with energy and commodity prices remaining firm on the back of geopolitical risks and continued supply-chain issues, there is a sense that inflation will remain stubbornly high through the medium term.

U.S. PMI data earlier in the week was strong and beat forecasts on both the manufacturing and services side, with the composite edging higher to 56.0 from 51.1 in January. Core durable goods orders (+0.7% vs. +0.4% exp.), Michigan consumer sentiment (62.8 vs. 61.7 exp.), and the jobless claims’ four-week average (236.25k vs 243.5k) all came beat expectations. The main releases outside of the U.S. were EU & UK PMIs, which also exceeded expectations, 55.8 vs 52.7 and 60.2 vs. 55.0 respectively. Couple the momentum with lessening impact of COVID, the economy could be ripe for a push forward once we get beyond the Russian-Ukraine war.

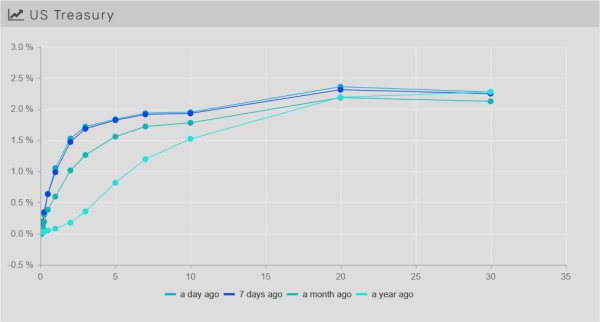

Seesaw week in rates as investors gauge the ongoing Russian-Ukrainian situation

Rates dropped earlier in the week on the Russian invasion of Ukraine only to rebound and ultimately end higher WoW. The yield range over the past week was +/- 15bps across the curve, ending with a slight bearish flattening as the 2yr continues to rise heading into March where the FOMC meeting will mark the first of a series of rate hikes. US 5y auction this week printed at 1.88%, up from 1.533% in January.

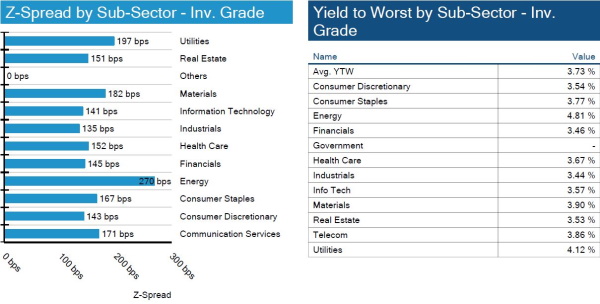

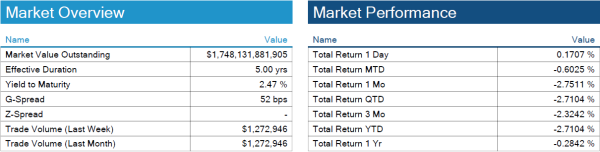

Credit spreads touch 12-month wides

Spreads widened ~5bps and are in line with 12-month wides. This has not slowed down new issues, but inflation and rate hikes could slow down new issuance during the second half of the year. IG market is -5.6% on the year relative to -6.3% compared to the S&P 500.

High yield spreads move wider

HY spreads widen ~3bps this week. There have been larger spread swings intra-week on changing energy prices but the silver lining continues to be a low default rate. Thr default rate continues to move lower month over month, and will be an indicator for any potential weakness in the space.

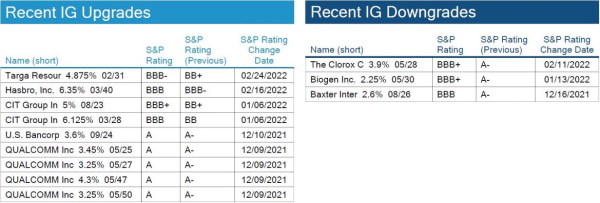

Small IG rating changes to specific issuer tranches

S&P downgraded a small portion of Clorox debt and upgraded from High Yield a small portion of Targus Resources debt.

Muni demand continues in the face of light supply

Municipal bond yields were slightly higher WoW, outperforming U.S. Treasuries on a total return basis as the new issue market continues to be light. The average weekly issuance is currently $9.7bn, well below the $11.4bn weekly average. Issuance is expected to lag and should keep the supply/demand technical intact for the foreseeable future. Puerto Rico is expected to exit bankruptcy next month as well.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, February 24, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

Alan Greenspan, 1991

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.