The Fixed Income Brief: Bat Out of Hell

Fixed Income Trivia Time:

When was the 10yr most recently at 1.83?

a. Jan. 2021

b. Jan. 2020

c. Jan. 2019

d. Jan. 2018

Note: We would love to hear from you, so please reach out to team@imtc.com.

—————–

The realization that Washington will be hard-pressed to pass the expected $2 trillion Build Back Better stimulus package leaves investors without a leg to stand on as inflationary impacts continue to plague markets and the economy. Inflation data has pushed the Fed to unwind faster than they originally planned and has sent rates higher to start the year, which has impacted many investors’ risk tolerance – hence we are seeing weaker credit and equity markets. Now that the fiscal stimulus is expected to be smaller and delayed, it impacts strategists’ economic growth forecasts, which will negatively impact underlining market expectations and cause more volatile markets as investors recalibrate their outlooks.

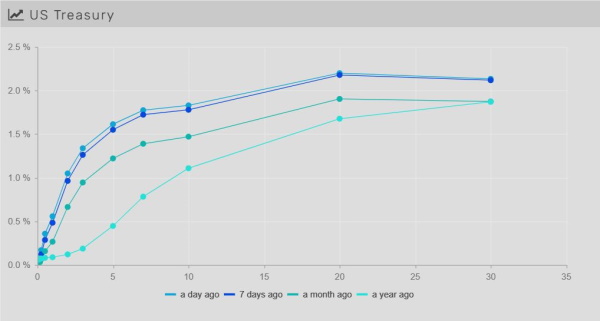

Volatile week with yields higher mid-week, but ultimately settle back on risks

Rates markets began the holiday-shortened week higher with rates moving up +10-13bps across the curve, only to settle roughly unchanged. The market is balancing continued high inflationary data and the Fed’s willingness to act aggressively with a risk-off tone from lingering COVID cases and continued Russian antics. Ultimately, the Fed’s trajectory to unwind stimulus is steeper than fixed income investors realized, and it will be difficult to get around the central bank’s target to limit consumers’ expectations of increased inflation.

To recap the WoW moves, the U.S. 2-year was up +4bps to 1.01% after being as high as 1.07%. The U.S. 10-year nearly reached 1.90% at one point, but ultimately ended the week down -1bps to 1.76%. The 5-year note got up +14bps to 1.69% at one point, to finish the week unchanged at 1.55%. The 30yr bond moved through the 2.20% level, up +10bps at its peak to settle back -3bps lower WoW to 2.08%.

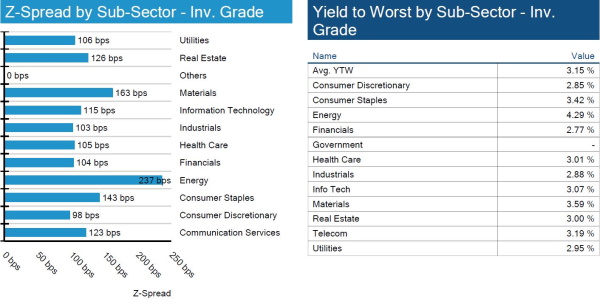

IG Yields move 3bps higher

Spreads widened 3 bps across BBB to AAA, while all-in yields move up higher with an increase in rates. Total return continues to move negative in 2022. Earnings can be an idiosyncratic driver on some names, but the current macro news does not have too many factors to help surprise the upside.

High yield spreads widened mid-week but end flat

HY spreads widened mid-week on macro news but end the week flat. With the increase in rates and volatility this year, the high yield market is negative on the yield but has outperformed IG by 90bps. The airline industry should see some pent-up air traffic come through in the short term, which can help recently downgraded Southwest Airlines.

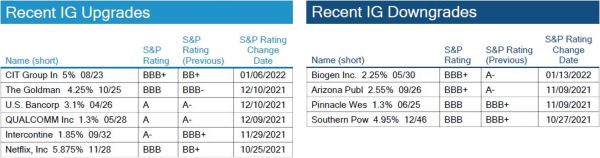

No IG rating changes this week, or on the year

No rating changes by S&P for IG issuers.

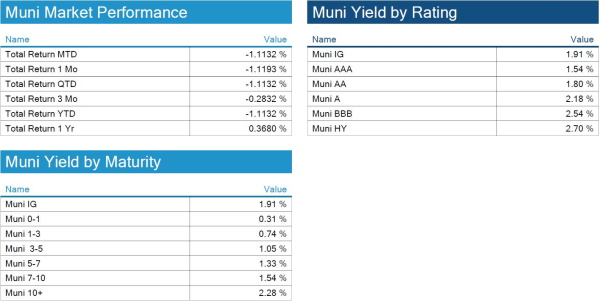

Muni total returns negative, but still outperform in rising rate environment

The municipal bond market is facing a challenge to its standing within fixed income markets in terms of handling a rising interest rate environment. The argument for munis is that retail-focused money is sticky and tends to hold in as other markets move. But, moves in rate markets and the chance that tax increases are not inevitable as investors thought has caused investors to stop adding here despite the increased credit quality overall.

So far this year, tax-exempt municipal bonds have lost -1.12%, and they are on track to post the worst monthly performance since February 2021. Despite posting negative returns, munis still beat Treasuries and IG credit, which have dropped -1.95% and -2.56% respectively. Muni mutual funds saw a $239 million withdrawal during the past week, ending a run of 45 straight weeks of positive flows.

We will keep an eye on the potential reversal of existing technicals as state and local governments may need to issue more debt than originally anticipated, and the backdrop of strong investor demand may be waning at the same time. Stay tuned.

*Disclosure on all charts: Figures shown above are the weighted aggregate of bonds that currently have an IDC price and based on transactions over the past 2 weeks. This may create anomalies in the data but aligns with our effort to reflect actual market conditions. Data pulled as of end of day Thursday, January 20, 2022.

View full IG, HY, and muni market reports pulled from IMTC:

Fixed Income Trivia Time:

b. Jan. 2020

Want to get this in your email every Sunday? Sign up to receive The Fixed Income Brief weekly.

.