The 2022 Outlook for Fixed Income

What a difference a year makes, but not in the ways investors expected at the start of last year. As 2022 begins, life is still not back to “normal” and we are seeing a mixed bag of concerns and positive signs. Office buildings are still waiting for employees to return, while leisure air travel in the U.S. is almost back to pre-pandemic levels (though business travel has still lagged). The unemployment rate has fallen dramatically, but businesses are struggling to find workers and wages are pushing higher. The term supply chain has become part of everyday vocabulary, and inflation is on everyone’s minds.

That sums up the themes we believe are likely to dominate bond markets in 2022, namely: Inflation, consumer behavior (another way of saying inflation), supply chain issues (another way of saying inflation), and the labor market (another way of saying inflation).

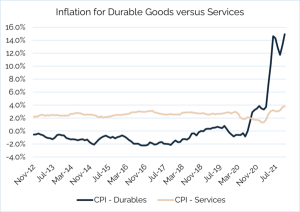

The Consumer Price Index has been higher in recent months than in the past 30+ years. Consumers are feeling it, but unevenly – prices for durable goods are up sharply, caused by supply chain woes (remember that COVID shutdowns caused the supply chain problems). Energy prices are much higher than a year ago, largely because OPEC has managed to hold firm on limiting output, boosting oil prices, and the cost of filling our gas tanks. The outlook for oil prices is a wildcard – while OPEC may continue to show discipline as demand picks up in 2022 and Goldman Sachs predicted oil will reach $100/barrel over the next two years, others expect prices to drop by 10%-15%.

While a shortage of workers is pushing wages higher, prices for many services are not rising by much. Only the gloomiest forecasters are calling for 1970s-style wage-price spirals, but increases in some key CPI components, namely wages, energy prices, and housing, are to outlast the short-term inflation expected for durable goods.

Source: St. Louis Federal Reserve (https://fred.stlouisfed.org/categories/9)

Supply chain snarls are expected to unsnarl over the next six months, and year-over-year inflation rates should start to abate by mid-2022. If the labor force participation rate continues to gradually increase, that should reduce upward pressure on wages. While rising COVID cases (Delta and/or Omicron) are prompting some jurisdictions to reinstate mask mandates, hospitals are struggling and some conferences and live performances have been canceled, we do not expect another economic shut-down. With GDP growth expected to be healthy over the coming year, there is little risk of a recession.

Government bonds: Spotlight on short- to intermediate maturity Treasury yields

While we have all heard this prediction before, things really are different this time. Previous forecasts of rising interest rates had been largely driven by the “can’t go any lower so they have to go up” school of thought. This time, the outlook is all about inflation; not the expectation that inflation had to happen at some point, but the inflation of here-and-now.

The Fed is on pace to wrap up its long-term bond purchases – initiated at the outbreak of the pandemic to support the U.S. economy– by the end of March 2022. That will free the Fed to raise short-term interest rates, and the most recent dot plot predicts three 0.25% increases by the end of 2022. While that is definitely a lift-off from 0%, it is not expected to impede economic growth.

We note that raising interest rates is typically seen as a way of cooling off demand by increasing borrowing costs for businesses and consumers. However, today’s inflation is not so much demand-driven as supply-driven attributable to the supply chain snarls that have been affecting us for almost a year now. It is not at all clear that raising the cost of borrowing will alleviate supply chain issues, but it would show that the Fed is acting to stomp on inflation. There is an argument to be made that inflation expectations can be a self-fulfilling prophecy, so squelching those expectations makes sense.

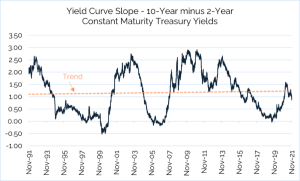

Indeed, the yield curve is flattening as shorter-term Treasury yields rise in anticipation of the Fed tightening but longer-term rates indicate little concern that high inflation will persist for years to come.

Source: St. Louis Federal Reserve (https://fred.stlouisfed.org/series/T10Y2Y)

What does this mean for investors? In our view, 10-year Treasury yields are unlikely to rise much beyond 2.25%, at least in the first half of 2022, for at least three reasons:

- Equity market volatility is likely to persist due to COVID-related uncertainties, which generates risk-off trades that support long-term Treasury prices,

- Investors appear to believe the Fed will prevent high inflation from becoming entrenched over a long period, and

- Demand for Treasuries from foreign buyers will continue.

The outlook for low yields does not make a compelling case for holding long-term Treasuries, and TIPS offer negative yields that can confuse many investors.

Credit markets: Spreads and default rates are near historic lows. Are they headed higher?

Corporate earnings rebounded strongly in 2021 as vaccine rollouts and government stimulus money encouraged consumer spending. While we do not expect economic growth and growth in corporate earnings to keep up the pace set in 2021, the economy is strong. GDP is likely to be in the 4-4.5% range in 2022. Revenues should continue to grow, and since businesses have thus far been able to pass along much of the increase in their input costs, credit quality across the investment grade spectrum should hold up well.

Of course, this rather upbeat forecast masks a number of uncertainties. Will consumers start to pushback against price increases? If so, companies may have to eat some of their higher input costs, reducing margins to retain market share. A related question is how long upward pressure on wages will persist – we are keeping an eye on the labor force participation rate, which has not yet recovered to pre-COVID levels. Demographics may keep that participation rate low, as some workers in the baby boomer generation retired earlier than expected due to COVID layoffs and/or fears about returning to the workplace.

If, as many expect, supply chain bottlenecks are largely resolved by mid-2022, inventories may become bloated, especially if retailers over-ordered to compensate for shipping delays. Retail sales growth could falter as consumers may have purchased all of the computers, home furnishings, etc., they want during their 2021 buying spree. That could put downward pressure on corporate cash flows but would also reduce inflationary pressures. The Omicron (and future) variants could dampen consumer spending on travel, restaurants, and other activities, which would further delay a full recovery in the service sector. Despite these uncertainties, we believe the likelihood of a recession over the next 12 months is quite low, unless some new, more deadly COVID variant takes hold.

The outlook for corporate bond issuance suggests a decline from 2021’s torrid pace. Interest rates are expected to rise in 2022 and the high volume of M&A activity seen in 2021 is not likely to continue into 2022. Investment-grade nonfinancial corporate borrowers still have ample cash on their balance sheets. High yield borrowers set a record for issuance in 2021, and a repeat in 2022 is unlikely.

What does this mean for investors?

Investment grade: In our opinion, today’s tight credit spreads mean that longer maturity corporates do not offer enough yield to justify their duration risk in a rising rate environment, even though we expect rates to rise at a measured pace. At today’s levels, a 0.50% increase in the yield on a 10-year corporate bond would push its price down by roughly 4.5%, far exceeding its yield. Short- to intermediate term corporate bonds with shorter durations are likely to outperform longer bonds through at least the first half of 2022. We also note that since yields on euro- or yen-denominated corporate bonds trade at spreads to government yields that are still negative, investment grade U.S. corporates are likely to remain the most attractive alternative in this sector of the bond market.

High yield: With spreads at historic lows, risks may be rising for high yield corporate bonds. While demand is high, the combination of interest rate risk and spreads risk is a double-whammy. Still, if rates rise slowly and credit concerns remain low, the high yield market may offer an attractive risk/return trade-off.

Municipal bonds: Strong demand meets limited supply?

Overall, demand for municipal bonds is likely to hold up well, even though fears of an increase in income tax rates for most taxpayers have faded. The percentage of the working population with incomes greater than $100K is now almost 22%, which provides support for tax-exempt bonds. While BBB issuers will face challenges over the coming year, strong tax receipts and the Biden administration’s infrastructure bill may take some pressure off of state and local government budgets. That is likely to keep new issuance muted in 2022, although some states may see strong investor demand as an opportunity to raise new money to fund some long-delayed projects.

What does this mean for investors? As in the corporate bond market, muni bond investors will be looking for yield, so lower-quality issues are likely to attract interest, keeping spreads tight. With wages rising and the stock market’s large gains in 2021, income tax receipts in most states should be strong for at least the first half of 2022. Assuming Treasury yields rise, the muni market should reprice, although not necessarily in lock-step with Treasuries and not consistently across all maturities. As recently as September 2021, 10-year AAA-rated GO bond yields had been close to 80% of Treasury yields. By December, demand pushed prices higher and the ratio had dropped closer to 65%, while ratios for 3- and 5-year AAA-rated GO yields were closer to 50%. Relatively modest new issuance should continue to support muni bond prices – municipal bond funds saw strong inflows in 2021, suggesting investors are willing to pay up for the tax advantages and diversification benefits of holding munis.

Emerging markets: In general, a favorable view

Emerging economies, especially those that depend heavily on tourism, are cautiously optimistic that 2022 will bring the full recovery that had been expected in 2021. A big unknown at this point is the Omicron variant that has led some countries to impose new international travel restrictions. On the bright side, the consensus view is that the run-up in the dollar has largely played out; if true, it will be easier for foreign governments to service their U.S. dollar debt.

What does this mean for investors? U.S. dollar-denominated sovereign debt rated double- and single-B may have some appeal to high yield investors. Local currency bonds may become more attractive to US investors both in terms of credit quality – bonds denominated in dollars will be easier for emerging economies to service as their currencies and economies strengthen – and for the potential upside of converting foreign currency into a weaker U.S. dollar.

A mixed bag of concerns and uncertainties for the bond market

There are unknowns that could increase risks. For example,

- Omicron – At the time of this writing, COVID cases are surging again. Broadway shows, NBA games, and large holiday gatherings have been canceled in many cases. If this variant causes a pull-back by consumers, growth forecasts could drop, and spreads on some corporate bonds could widen.

- Inflation pressures – While year-over-year increases in durable goods prices should decline by mid-2022, wages and energy prices could continue to grow. That could push the Fed to act more aggressively.

- RTO and business travel – The Return to Office date for many employees has been pushed back (again). That hurts many small businesses that depend on spending by office workers and could lead to layoffs, and the recent growth in business travel may stall, hitting the rental car business and hotels that cater to business travelers. That could hurt state and local tax receipts associated with business travel.

- Fallout from Fed actions – Will the end of Fed purchases of long-term Treasuries have an effect on liquidity and yields? Right now, it seems unlikely as both the European Central Bank and Japan’s monetary authority plan to keep rates near or below zero, keeping the U.S. Treasury market the most attractive risk-free investment available.

Lastly, asset managers and investment advisors are being asked, “Why should investors hold bonds in 2022 when interest rates are certain to go up?” Our response: bonds protect investors from the volatility of the equity portion of their portfolios. We expect 2022 to be a volatile year for equities and investors will want to avoid having to sell stocks at a low point to raise cash. Bonds offer returns that are better than money market rates, but we believe it is prudent to limit duration risk as we move into 2022, even though it means settling for lower yields from the fixed income component of a diversified portfolio.

.