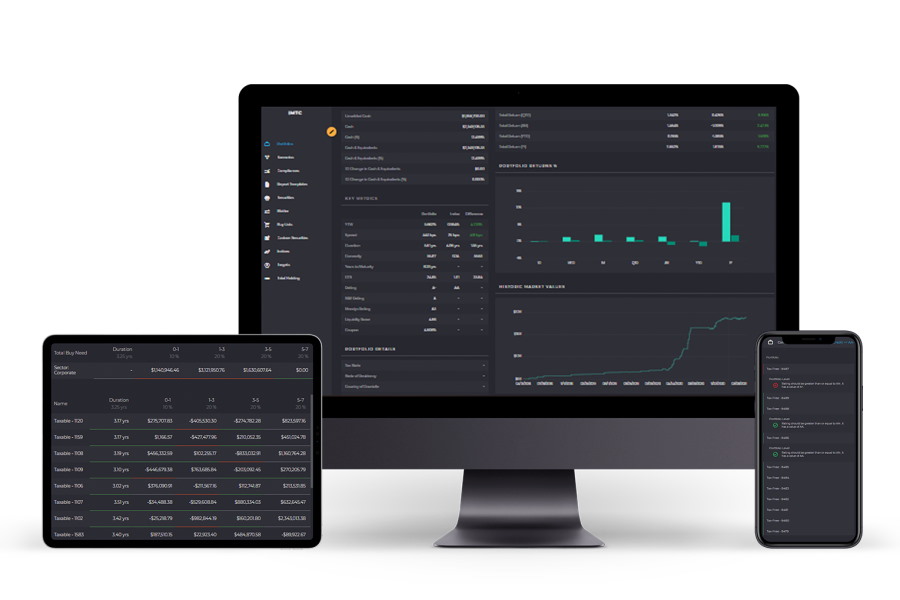

IMTC Unveils The Future of Fixed Income Investment Management Technology

IMTC launched its new and improved cloud-based investment management system to enable fixed income managers to make more precise investment decisions, faster.