4 Takeaways from the 2023 Orion Ascent Conference

Our team recently attended the 2023 Orion Ascent Conference in Orlando, Florida and had a great time networking with new and familiar faces. The conference had a stated goal of “giving advisors the tools they need to lean into change and embrace innovation, disrupt the status quo, and ultimately win for themselves and their clients”, and it accomplished just that. We enjoyed taking the time to highlight what we do, as well as exchanging ideas about innovation and how to stay relevant in a changing market.

Here are some main takeaways from the conference and how they affect fixed income management.

1. The importance of customization and a personal experience for clients

Market volatility is higher than any period over the last 70 years, and clients are feeling the pressure. It can be more challenging to deal with clients during volatility: in addition to general stress, cognitive and emotional biases will always affect how clients feel about investments.

The answer here? Prioritizing a personalized experience for investors. 60% of clients stick with an advisor for service, not strictly returns. 78% of high-net-worth investors believe the best advisor is one who knows them well.

Age plays a role here as well– money is “moving younger” and younger generations who have seen custom strategies outperform ETFs for years are requesting more personalization from advisors than ever before.

With the right strategy in place, advisors can look past this market volatility and create opportunities further down the road:

“Periods of turmoil create opportunities for fixed income investors, and this opportunity can be seen historically 18-months following a recession such as the one we are currently experiencing” – Matt Dalton, CEO of Belle Haven

With this personalized experience in mind, advisors are now transitioning to focus more on goal-based investing to align client priorities with investment decisions, leading to better outcomes overall.

2. The value-add of model portfolios

Provide customization while working smarter, not harder. Model portfolios enable advisors to provide core strategies with greater customization. This customization can be adjusted on an ongoing basis with the right technology. These portfolios allow advisors to be flexible to clients’ needs while still being able to scale quickly.

62% of clients are now aware of model portfolios, but some advisors still struggle to differentiate their model to prove outperformance. One recommendation is to pair models with a separately managed strategy or portfolio so that client risk tolerance and personal needs are blended.

3. Trends shifting toward custom indexing

There was a lot of talk about custom indexing on both the equity and fixed income side. As fixed income technology evolves, trends are shifting toward more advisors using software tools to create custom indexes for their clients. Investors are searching for a more personalized approach to investing (rather than one-size-fits-all), and custom indexes create flexibility around client circumstances and individual preferences. Advisors can implement custom indexes in SMA form and restrict or prioritize buys and sells based on client preferences.

If you are interested in these offerings in the fixed income space, please contact our team to learn how we help other Orion users.

4. Increasing demand for both tax exempt and taxable munis

While speaking with managers at the conference there was plenty of discussion around a new bill from the White House being released this month, which will increase taxes on individuals making over 400k annually. This will further increase the demand for munis–a market that is already dealing with limited supply due to an infrastructure bill that has boosted their balance sheets. This will create a perfect storm of limited supply paired with a rising demand.

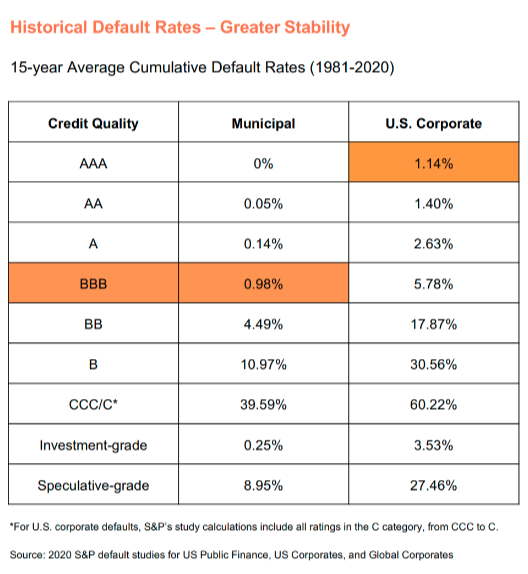

Tax-exempt munis is not the only area experiencing higher demand. Taxable munis can offer strong risk-adjusted returns for clients. Just look at the AAA corporates default rates in comparison to BBB muni. Given the number of concerns around the markets, now is a crucial time to add quality to the portfolio.

The taxable muni market has grown 58% over the last six years, with demand expected to only increase in the coming year as they offer attractive risk adjusted returns and increased demand both domestically and abroad.

…

It was a packed three days full of valuable content, thought-provoking topics, and networking. We look forward to attending Orion Ascent next year to continue to gain valuable insight and better serve the fixed income community.

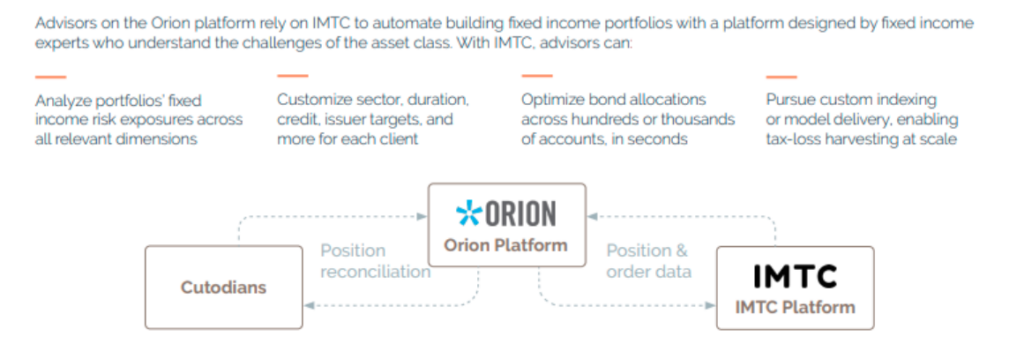

IMTC is proud to partner with Orion to help their clients offer enhanced fixed income capabilities. IMTC seamlessly integrates custodial data from Orion to help clients deliver customized fixed income strategies through enhanced laddered portfolios, custom indexing, and portfolio optimization. Orion and IMTC are both API-first firms, which enable our shared clients to derive value on day one.

.