The Resurgence of Fixed Income SMAs: Have It Your Way!

Years ago, one of the largest fast-food chains in the U.S. made a big hit with its advertising slogan, “have it your way.” The message behind the slogan was that its competitors relied on assembly-line tactics to churn out food quickly, but this king of burgers was happy to hold the pickles, hold the lettuce, or whatever else the customer wanted (our apologies if you now have the old commercial jingle stuck in your head).

Today, many financial advisors (FAs) and wealth managers are seeking to embrace the “have it your way” philosophy by offering separately managed accounts (SMAs) to a growing number of clients. This trend, seen in both equity and fixed income account management, is driven by a variety of factors including tax-efficiency, owning the underlying bonds, and embedding client preferences. Couple these factors with investment management firms working to maintain market share and remain competitive, and as a result, many are seeking to offer SMAs but the challenge is how do we make that scalable.

Fixed income investing requires market participants to review many different factors prior to investing – no fractional shares, mostly needing to buy in measurements of 1000, and more data points to analyze. Not only are there more bond issuers than on the equity side, but fixed income managers also need to assess each issue. It’s not about just looking at the names, but also at maturities, ratings, and seniority for each issue. With the added layers of complexity, fixed income SMAs are more challenging and nuanced, so what is driving the popularity of these accounts?

The current market landscape makes bonds more attractive

Fixed income investments now offer meaningful income versus the days of zero-ish interest rates. The Fed’s move to increase short-term rates from 0% to over 5% means has shifted greater focus on and investment into fixed income securities. With five-year Treasuries offering an (almost) risk-free yield that rivals the earnings-per-share yield on the S&P 500, many investors are shifting money back into bonds.

Morningstar reports that in the first half of 2023, organic growth for funds was weak at best across most asset classes, except bond funds and international equities. Many wealth managers are more heavily allocating out of equities and into bonds across the board, as highlighted in this table by Morningstar1:

However, while fixed income has become more attractive overall, and bond mutual funds and ETFs are a useful place to park cash, there is a growing recognition that bond mutual funds can face liquidity crunches when sales exceed purchases and the fund sells the holdings with the greatest demand to generate cash, leaving the fund somewhat less attractive issues. Even though there have been positive inflows overall into both taxable and muni bond funds, there have been outflows from bond funds into bond SMAs at the same time.

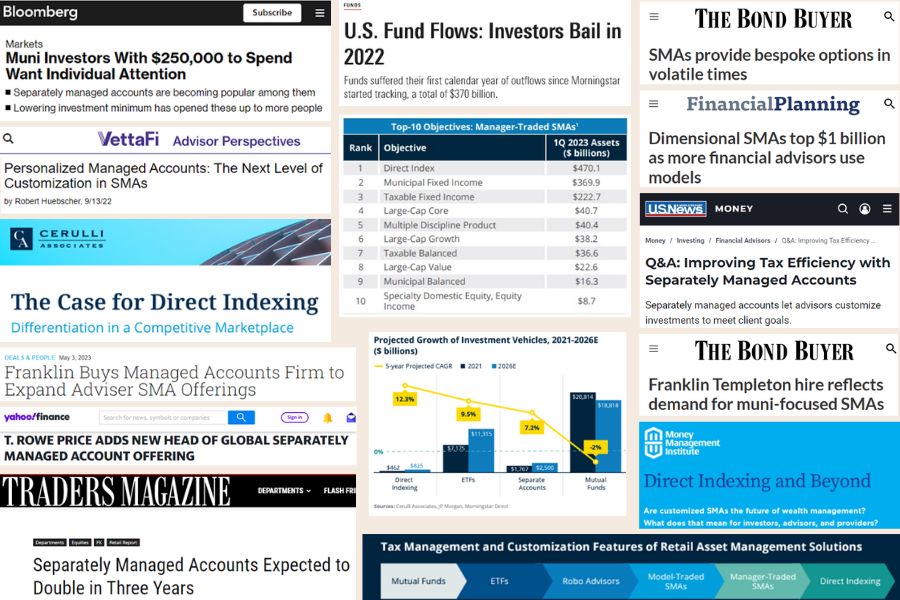

Cerulli2 recently reported that of the asset classes that saw the greatest flows out of funds and into manager-traded SMAs in 2023, Municipal and Taxable Fixed Income funds were #2 and #3, respectively.

According to Bloomberg, SMAs are becoming popular with investors who have municipal bond portfolios of just $250,000, showing the ability to provide these customized offerings at lower account minimums. Asset manager Franklin Templeton recently acquired a startup firm that provides SMA and other personalized portfolio management solutions, building out their solutions in this space. T. Rowe Price just added a new Head of Global Separately Managed Account Offerings. All of these news headlines demonstrate just how prevalent the growth in SMAs has become.

Why has there been a growth in separately managed accounts (SMAs)?

Wealth management is a competitive space with firms continually seeking out the latest competitive edge whether it’s a focus on technology and process efficiencies, gaining economies of scale through acquisitions, or the ability to attract new business. Winning new business can come by expanding their product offerings, expanding their market by lowering account minimums, or demonstrating their firm can serve clients better (i.e., tailoring portfolios for clients). As a result, firms are moving money into SMAs, and this growth in popularity of SMAs is driven by three main benefits:

- Increased transparency and control. For many clients, it is not enough to run through a list of standard questions about their goals and needs, then combine mutual funds and/or ETFs to build portfolios that all look fairly similar except for the fund weightings. Wealth managers are taking the strategies they like (existing mutual funds and ETFs) and mimicking them in a SMA wrapper that matches the exposures while having a custom make up of underlying securities.

Having direct ownership of securities provides greater transparency and flexibility. Visibility into the underlying holdings helps control exposures and potential tax consequences more effectively, while also allowing for clients to select certain issuers if desired. Direct ownership also appeals to investors who saw the value of their bond funds decline as interest rates rose sharply starting in 2022. Investors who had established positions in those funds pre-2022 would realize losses if they sold their shares today. In contrast, holding individual bonds can be held to maturity to avoid losses. - The demand for customization. In a world where consumers are seeing increased customization across the board, it’s natural that it’s starting to extend into investments as well. Whether you’re looking at your favorite news site or selecting meals from a delivery app, companies are tailoring preferences for each individual. Do you only want market news and sports updates on your news feed? Do you want your delivery service meals to be gluten-free, vegan, or keto? Well, the same expectations are crossing over into wealth management.

Offering SMAs is a way to show clients that an advisor is truly attentive to their specific needs and preferences, and to offer customized holdings for each client. For example, SMAs enable a wealth manager to set a target yield, duration, or select state preferences. These preferences can be accommodated while also avoiding certain industries or adding in ESG parameters that align with their preferences. Home offices and the asset managers they work with need to be able to provide this capability through advisory platforms. - Enhanced tax optimization for clients. SMAs offer opportunities for tax-loss harvesting that is not possible with bond mutual funds or ETFs. The ability to sell bonds with losses to reduce tax burdens appeals to many high-net-worth individuals. And while ETFs capture some tax efficiencies through their creation and redemption process, they are typically passive, index-tracking vehicles whose duration and other characteristics may not match an investor’s needs. With an SMA, it is also more tax-efficient to transfer individual bonds from one strategy to another. In sum, both model- and manager-traded SMAs offer opportunities for tax optimization and the ability to customize exposures that bond funds cannot provide.

Why don’t all advisors and wealth managers offer SMAs?

While some firms have been early adopters in expanding their fixed income SMA offerings to more clients, many are playing catch-up or have not even taken the first steps in that direction. This puts those slow adopters at a clear disadvantage. Cost barriers and fee pressure are the top reasons that home offices shy away from offering SMAs, setting high account minimums of $1 million or more.

The ability to handle SMAs at scale benefits home offices and asset managers as well as FAs, given that investors are shifting more of their allocations back to fixed income and buying more individual bonds. But mass customization is simply not possible without a technology platform designed with the fixed income workflow in mind. It is too difficult and cumbersome to customize accounts on a large scale without the right tools. Hiring more people to do the work manually is not feasible given the competitive pressures to keep fees low. New tools in the fixed income space are making it feasible for FAs and wealth managers to offer SMAs to the mass affluent as well as high net worth clients, using efficient trade allocation, tax optimization, and policy-driven risk monitoring.

Particularly in the current environment, firms who see the resurgence of bond SMAs in the industry are eager to capitalize on the opportunity. Many wealth managers want to launch new products or bolster existing products to meet the demands of their clients. Firms that historically focused solely on mutual funds are now trying to figure out how to maintain market share by launching SMAs, and this trend is not only for tax exempt but also taxable accounts. With these products, they’re offering customization, tax loss harvesting, and direct indexing. In order to achieve this, the firms need to remove operational friction that’s driven by legacy systems.

How IMTC is enabling SMA growth and customization at scale

Dedicated fixed income platforms, such as IMTC, streamline processes across large number of accounts, enabling advisors, home offices, and asset managers to facilitate SMA offerings. When fixed income managers don’t need to manage one account at a time, that drives mass efficiencies and drastically reduces the amount of time spent on each account. This helps firms to lower account minimums, serve more clients, and offer personalized portfolios.

IMTC is partnering with wealth management firms so they can launch new SMAs, enhance existing products, and drive operational efficiencies to support the growth in bond SMAs. Clients are utilizing our technology to:

- Identify accounts that need attention with easy filtering and dashboards

- Optimize accounts simultaneously with CUSIP-level buys/sells that are in line with manager preferences

- Equitably allocate a trade across accounts using rule-based protocols

- Maintain unique investment strategies, targets, and client requests with codified compliance rules

- Gain pre-trade visibility into the impact of and compliance adherence of a trade

In addition to functionality that enables customization at scale, IMTC’s cloud-based platform integrates into any platform or data source. This eliminates the need for switching across systems and manual data entry. It also removes the burden of using Excel to manage billions of dollars of accounts. The cloud-native architecture of the platform means firms can easily scale resources up or down based on needs. This helps firms to future-proof their operations and build off a modernized technology stack.

Conclusion

Advisors know they need to be able to offer SMA capabilities or they will lose clients. According to a 2022 report by Cerulli Associates, the vast majority of high-net-worth investors want their advisor to minimize their tax bill using tax-efficient investments strategies. In the fixed income arena, this demands an SMA approach, which in turn requires a technology platform designed to deliver efficiencies at scale.