Release Notes: New Integrations, Enhanced What-If Scenarios, and Increased Control of Allocation and Optimizer Results

Capture data from any source with new integrations and open API

Data is king when it comes to making the best investment decisions for your clients. As an investment manager, you must be able to access a wide variety of financial, aggregate, bank and tax data quickly and in real-time. With IMTC’s latest update, users not only have greater access to information from leading custodial aggregators such as SS&C APX, Orion, and Vestmark but can now transmit data to the IMTC system through our own open API.

Now, using IMTC’s new integration capabilities, you can:

- Access leading aggregate data providers including APX, Orion, and Vestmark

- Populate the platform with any custom data file through the open API

Drill down into what-if scenarios with enhanced portfolio visualization

Understanding the impact of trades in a scenario, quickly, is critically important in making investment decisions. Although IMTC has provided the valuable capability of being able to scan hundreds of portfolios to see the pre- and post-trade impact of proposed trades, our platform didn’t have the ability to dive into an individual portfolio in detail until now. This capability allows you to automatically validate scenarios without time-consuming data manipulation in a spreadsheet. With this latest update, IMTC’s system has added the ability to drill down into the details of individual trade proposals, allowing wealth managers to make better investment decisions, faster.

Now, using IMTC’s enhanced visualization capabilities, you can:

- View a dashboard at the portfolio level of pre- and post-trade impacts

- Drill down into the scenario at the portfolio holdings level

- Gain more compliance awareness with detailed delta metrics

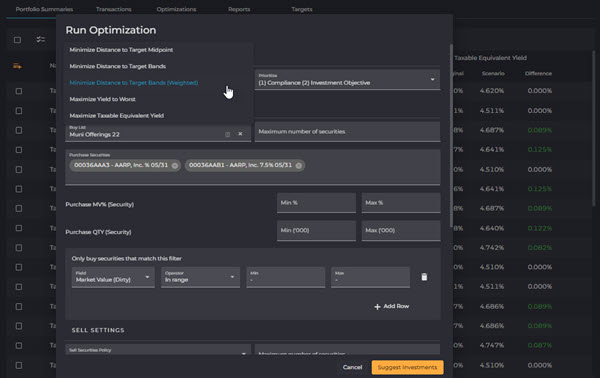

Increase control of your investment decisions

IMTC has expanded options within both its Allocation and Optimizer modules to bring hypothetical situations to reality with ease. While automation does provide significant time savings for portfolio managers, they need to have a wide range of inputs to ensure the system can provide ideal investments for each portfolio. Now, IMTC allows you to customize multiple waterfall logic allocate funds across portfolios and has added many new factors to input for Optimizer results, resulting in accelerated and more precise investment decisions.

Now, with additional Optimizer parameters available, you can:

- Customized Waterfall Allocation: Customize logic in allocation decisions before they are needed

- Optimizer Parameters: Expanded input criteria to control investment objective priorities and buy/sell settings

- Edit allocation and optimization results in line to easily modify investment decisions

For information on IMTC’s investment management platform, please contact team@imtc.com or reach out to our team.