Fixed Income Order Management System

A fully integrated solution that offers live pricing allowing users to manage orders and execute trades via a simple and intuitive workflow.

End-to-end order lifecycle coverage from screening inventory to execution and allocation

IMTC’s actionable order management system with direct connections to execution venues enables portfolio managers and traders to make trading decisions faster, with less risk of errors, while keeping portfolios updated intraday.

Automate and centralize trade capture details

Stop re-keying critical trade information. Manually entering trade confirms and switching across systems is a time-consuming and error-prone process. Consolidate your trade capture process to reduce trade discrepancies and the potential for expensive mistakes.

- Directly connect to other platforms to streamline trade details across custodians, accounting systems, and trading and execution management platforms.

- Remove the burden of manual data entry and reconciliation from traders and middle- and back-office teams.

- Prepare for T+1 settlements and updated TRACE reporting requirements with automated data transfers.

Connect directly to your custodians and counterparties

Establish a comprehensive data hub by integrating existing systems and custom feeds across various data sources and platforms. Achieve instant access to portfolio data, trade confirmations, cash balances, live inventory, and more, eliminating the need for manual data transfers and reducing the risk of errors.

Portfolio data

Live offers

Routing & execution

CRM

Unlock actionable liquidity with live quotes

Execute trades with confidence and find liquidity in a fragmented market with real-time pricing.

- Access to live offers and pricing data integrated into your portfolio management and trading processes to achieve best execution.

- Easily compare inventory and pricing from multiple data sources to make faster investment decisions without switching across systems.

Manage portfolios & orders in one system

Utilize IMTC’s portfolio construction and optimization tools in the same system as managing orders and confirming trade details.

- Run Scenarios and Optimizations to mockup orders with the ability to promote orders directly to the trade blotter.

- Access all relevant data in one system – including cash balances, custodian data, compliance, and more.

- Ensure compliance with investment rules and targets codified into each investment decision, including post-trade allocations.

CUSIPs vs. Characteristics: Managing Fixed Income Portfolios to a Model

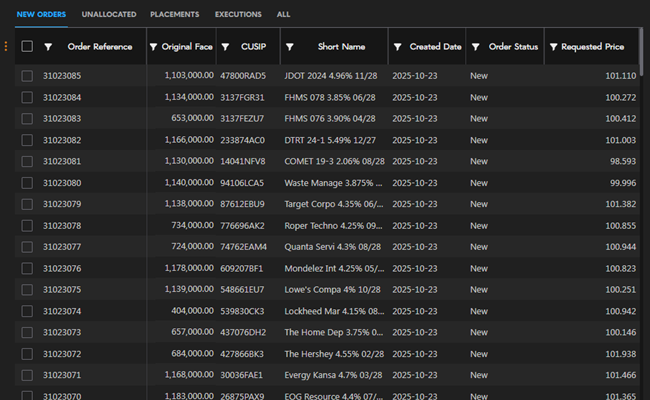

Gain visibility into firm-wide transactions

Enhance transparency and communication on proposed and fully executed orders across the investment team to achieve best execution and maintain a record of trading activity with IMTC’s Trade Blotter.

- Transmit allocations directly to execution partners

- Reconcile orders across all custodians

- Aggregate and block orders across the investment team

- Maintain an auditable source of all trades

- Add custom instructions and notes to orders

- Designate permissioned roles for submitting orders

Allocate trades across portfolios

While IMTC enables portfolio managers to equitably allocate across accounts pre-trade using live inventory, PMs can still run user-defined, rule-based protocols after a trade is executed. Pro-rata and customizable waterfall approaches bring precision and fairness to the investment process.

Leveraging the power of the cloud, portfolio managers can apply these allocations across all portfolios simultaneously without compromising on portfolio guidelines.

Fixed Income Trade Allocation: How Technology & Automation Ensure Equitable Bond Allocation Processes

IMTC Wins Best Integrated Front-office Platform from Waterstechnology in 2023

Access intra-day portfolio updates

Improve accuracy and speed of managing portfolios with trade insights updated in the system immediately while still protecting against account overdrafts.

Evaluate the impact of promoted orders on portfolios as trades are executed and see executed trades updated in portfolios intraday.

Want to learn how IMTC helps your firm to outperform?

Speak to our sales team. Our team has a consultative approach to help you assess if IMTC’s technology is right for your firm.

-

info@imtc.com

-

110 E. 42nd Street, Suite 805 New York, NY 10017

-

(917) 310-2218