Deliver highly customized fixed income products

Expand the range of solutions at various price points and wrappers to grow your market share without prohibitive manual, time-consuming processes.

Are you looking to expand current strategies but lack the infrastructure to do so efficiently?

Offering new strategies such as SMAs, model portfolios, tax-optimized accounts, and more to meet the changing demands of end clients isn’t scalable with current technology. Using a combination of legacy technology and spreadsheets to make decisions while communicating with clients, sponsors, and custodians is slow and prone to errors.

IMTC can help if you’re having difficulties with:

Adhering to unique strategies

Managing cash and cashflows

Allocating across accounts

Automating post-trade workflows

Optimize and automate fixed income management with a fully integrated, turnkey platform

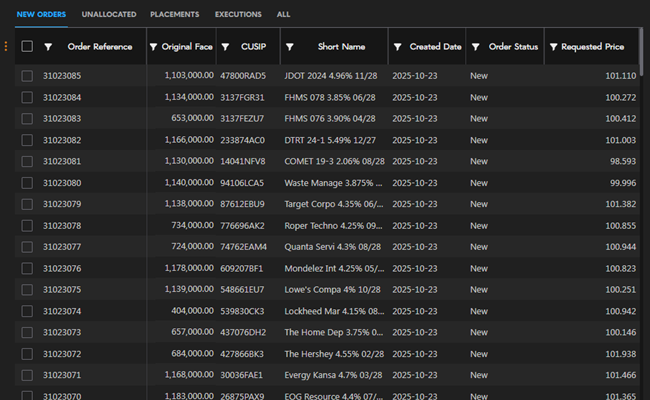

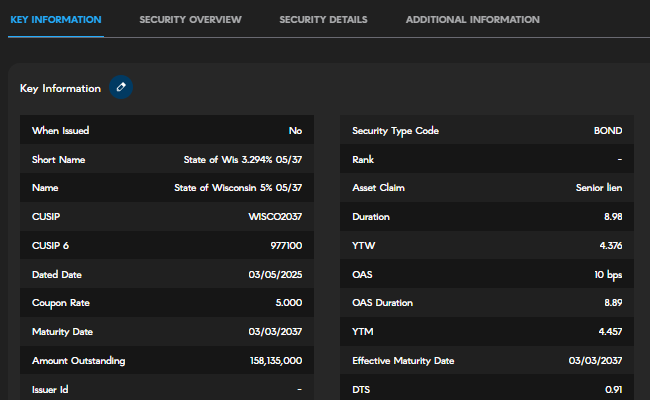

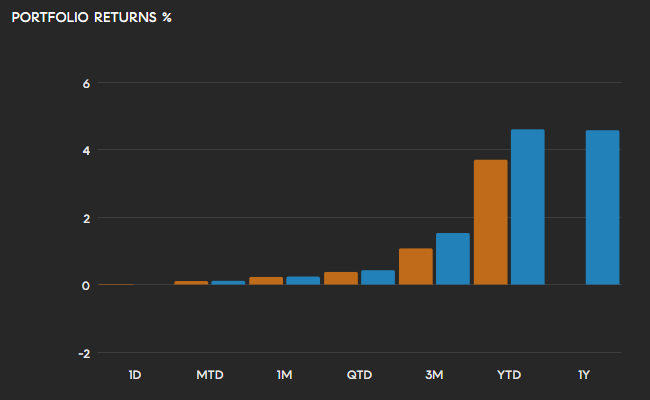

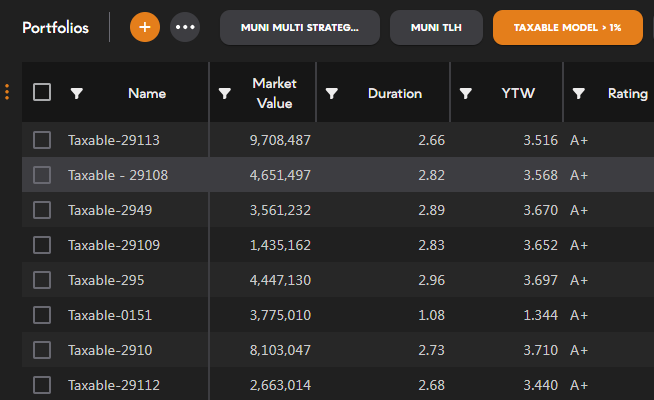

- Optimize portfolios en masse for actionable outcomes that are in line with investment strategies and preferences

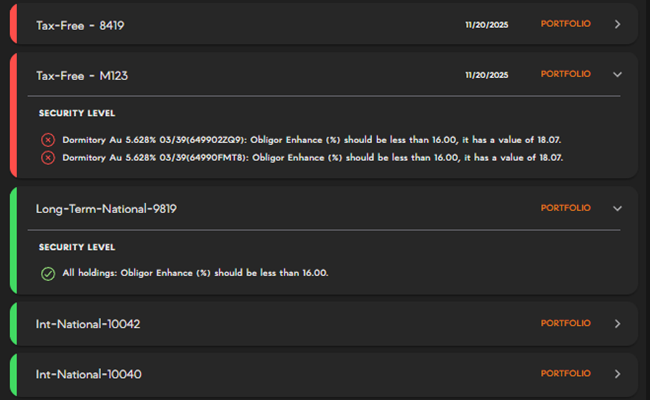

- Adhere to complex and customized investment rules or remain in line with a model portfolio

- Allocate bonds equitably across accounts while remaining in line with rules

- Ensure post-trade efficiency with seamless connectivity into all necessary data and platforms

Implement investment ideas across accounts, faster, with IMTC

Transform your ability to scale fixed income management when you can make investment decisions with speed and accuracy not before possible.

of our clients are able to offer increased customization within 6 months of using IMTC

days in which a client can successfully launch new customized SMA offerings

94% of our clients are able to meaningfully scale fixed income management

reduction in time spent allocating trades

Explore how IMTC clients are using IMTC

Streamline fixed income management with a comprehensive and flexible suite of modules

Latest insights

Fixed Income Trade Allocation: How Technology & Automation Ensure Equitable Bond Allocation Processes

Axios: Exclusive: Lord Abbett backs fixed-income platform IMTC

Want to learn how IMTC helps your firm to outperform?

Speak to our sales team. Our team has a consultative approach to help you assess if IMTC’s technology is right for your firm.

-

info@imtc.com

-

110 E. 42nd Street, Suite 805, New York, NY 10017

-

(917) 310-2218