Optimism Amidst Record New Debt Issuances and Job Losses

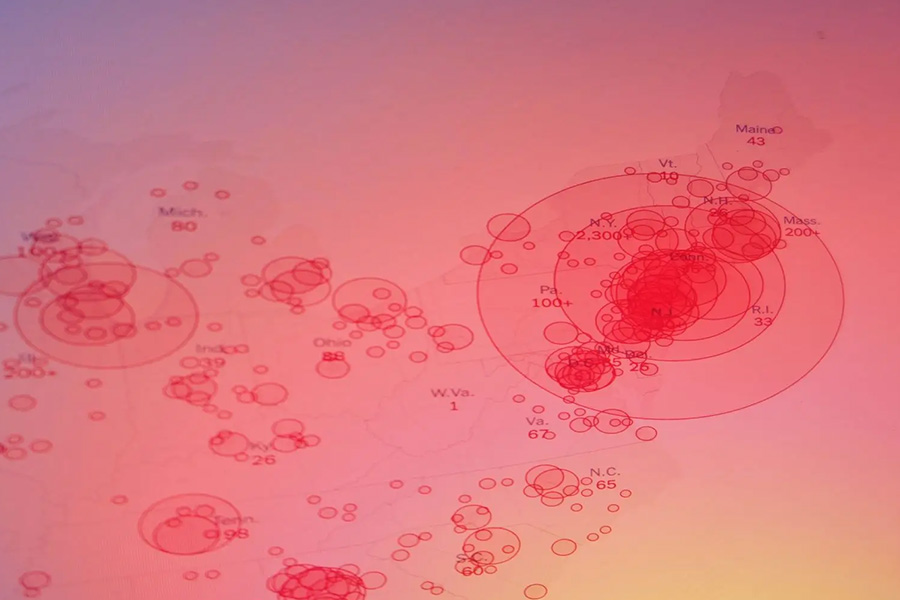

Coronavirus lockdowns continue to have a significant impact on the economy with the full-scale ramifications still to be determined. As record job losses hit their biggest decline on record this…