F.L.Putnam Investment Management Case Study: Scaling Fixed Income SMAs and Model Strategies

Navigate through the video by clicking on the chapter markers!

———

The IMTC team sat down with Ryan McQuilkin, Principal, Managing Director of Fixed Income, Portfolio Manager at F.L.Putnam Investment Management to learn more about his experience as an IMTC client.

Watch the full video interview, read the highlights, download the PDF, or read the transcript below.

Challenge: Managing accounts efficiently and at scale with robust data

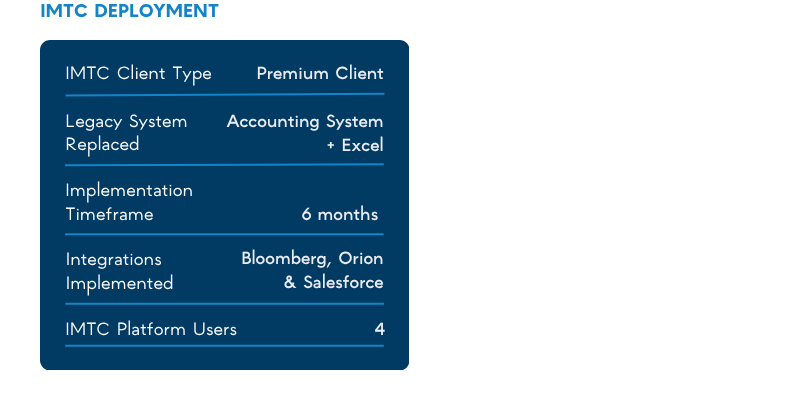

F.L.Putnam Investment Management, a national RIA, needed to improve their ability to synthesize, analyze, and trade fixed income portfolios efficiently. When managing modeled strategies and SMAs, the team had to source data from multiple systems and incorporate Microsoft Excel. Manual allocations, transferring data, and frequent switching between systems made portfolio management time consuming and labor-intensive. With both taxable and non-taxable strategies in mind, F.L.Putnam needed a system that allowed for a tailored, rules-based approach to build and maintain client portfolios, driven by duration targets and sector positioning.

Solution: Streamlined portfolio management results in time savings

F.L.Putnam’s decision to adopt the IMTC platform stemmed from the technology’s ability to streamline portfolio management processes with cost-effective, innovative solutions. Key modules such as the optimizer, compliance rules, and duration targets provided invaluable support, allowing the creation of orders across numerous portfolios simultaneously. The team also appreciated IMTC’s continual improvements in the platform.

- Portfolio optimization: Create optimal orders for a large number of portfolios at once while remaining in line with strategy and targets.

- Systematized bond allocation: Execute a structured, rules-based allocation process aligning with market positioning and unique characteristics.

- Platform connectivity: Enhance workflows with aggregated data, streamlined trading, and automated portfolio updates and allocations.

- Data visibility: View duration, compliance maintenance, and other portfolio characteristics on the fly.

Results: Ability to scale fixed income management

Since adopting IMTC, F.L.Putnam has experienced significant time savings and enhanced decision-making capabilities. The streamlined processes and connectivity across platforms have allowed for more efficient portfolio management, enabling the firm to scale operations effectively. The team has also minimized manual processes, switching across systems, and using Excel to manage accounts. Overall, IMTC has empowered F.L.Putnam to manage client portfolios more cost-effectively, aligning seamlessly with their clients’ needs and future growth aspirations.

Looking ahead, F.L.Putnam plans to execute trades directly from the IMTC platform and integrate live pricing to further enhance their portfolio management capabilities.

Key outcomes:

- Accommodate future account growth without additional headcount or cost

- Streamline and optimize order allocation generation process

- Modernize technology for fully connected, automated workflows

Learn more about F.L.Putnam Investment Management here.

———

Can you please introduce yourself and your firm, and tell us what type of fixed income strategies F.L.Putnam offers?

My name is Ryan McQuilkin and I am the Managing Director of Fixed Income at F.L.Putnam Investment Management. We are a nationally registered investment advisor that offers a wide range of wealth and investment management solutions for individuals, families, and institutions. Our process is to build out custom fixed income portfolios, separately managed accounts, or SMAs, within client portfolios. We offer taxable and tax exempt strategies as well as cash management solutions. We also design custom portfolios for clients.

What challenges were you facing before adopting the IMTC platform?

Prior to adopting the IMTC platform, we had identified a desire to improve our ability to synthesize, analyze, and trade our client fixed income portfolios more efficiently. We’re managing model strategies and SMAs. We previously needed to source data from multiple systems and collate that data using Microsoft Excel. Manual allocations, transferring data, and frequent switching between systems made portfolio management time consuming and labor intensive. We ultimately needed a system that allowed for a tailored rules-based approach to build and maintain client portfolios which was driven by duration targets and sector positioning. And I would say we also needed a technology solution that was fixed income specific.

Why did you choose IMTC as your platform, and what features influenced your decision?

So our decision to choose IMTC was primarily driven by the cost and the value of the services offered through the platform. We were impressed with the Optimizer, which allows us to create large orders for a bunch of portfolios simultaneously. This feature was an important innovation and also a key factor in our decision. We also needed a platform that we believed would improve over time to support our needs. So ultimately IMTC was the choice for us.

How do you currently use the IMTC platform in your day-to-day operations?

We are currently using the Optimization module, the Scenarios, the Compliance rules and also the duration Target modules. We use the Scenarios and the Optimizer to build orders quickly for a large group of accounts, and also the compliance rules and duration targets are also valuable inputs into that process. In addition, IMTC connectivity with trading platforms and its ability to generate rules-based allocations has been one of the most valuable improvements to the platform overall and it’s one we use quite a bit. We have previously done allocations via a manual process.

What improvements have you seen since implementing IMTC, and how has it impacted your workflows?

We’ve seen notable improvements to our workflows. They have become more efficient while also allowing us to work through and access a greater amount of data. We have cut down on the amount of time it takes to review a portfolio and automated the previously manual trade allocation process. We can now view all of our data in one place. I think in the future we expect that IMTC will help us continue to scale our ability to manage portfolios, likely without material increases in cost or headcount.

How has your experience been working with the IMTC team?

The IMTC team has been great to work with over the past few years. We’ve had great experiences with both the developer and client teams. They are very accessible and receptive to the improvements we’ve suggested. Since we started working with the IMTC team, there have been several positive enhancements to the platform which have helped us quite a bit.

What future plans or initiatives are you exploring, and how does IMTC fit into your long-term strategy?

As a firm, we are considering various future initiatives including the addition of new strategies, allocation to new fixed income sectors, and the implementation of new trading workflows. Ultimately, we believe IMTC’s cloud-based platform is the right solution to help us achieve those goals and enhancements over the coming years.

This paper is intended for information and discussion purposes only. The information contained in this publication is derived from data obtained from sources believed by IMTC to be reliable and is given in good faith, but no guarantees are made by IMTC with regard to the accuracy, completeness, or suitability of the information presented. Nothing within this paper should be relied upon as investment advice, and nothing within shall confer rights or remedies upon, you or any of your employees, creditors, holders of securities or other equity holders or any other person. Any opinions expressed reflect the current judgment of the authors of this paper and do not necessarily represent the opinion of IMTC. IMTC expressly disclaims all representations and warranties, express, implied, statutory or otherwise, whatsoever, including, but not limited to: (i) warranties of merchantability, fitness for a particular purpose, suitability, usage, title, or noninfringement; (ii) that the contents of this white paper are free from error; and (iii) that such contents will not infringe third-party rights. The information contained within this paper is the intellectual property of IMTC and any further dissemination of this paper should attribute rights to IMTC and include this disclaimer.