What Can Active Fixed Income Investment Managers Learn from SpaceX?

IMTC was invited to participate in the ABA’s Wealth and Trust Conference in February 2021. Our COO, Russell Feldman, took the opportunity to challenge asset and wealth management professionals to learn from Elon Musk’s/SpaceX’s strategy of upending the space industry’s traditional ways of doing business.

By focusing on innovation and rejecting the status quo, SpaceX improved outcomes and cut costs without sacrificing quality. But, are there really parallels between building spaceships and finding better ways to serve investment management clients? Russell discusses the highlights below and you can watch the full presentation for more insights.

As the COO of IMTC, I spend a good deal of time thinking about how we can create technology solutions that are not just marginally better, but radically better than what’s currently available in the market. When I think of radical innovators, the first name that comes to mind is Elon Musk. While his public persona may be eccentric, there is no doubt that he is a visionary who sees and pursues opportunities in a big way.

SpaceX is a great example of what can be accomplished when we approach a big challenge using new ways of thinking. Can we apply SpaceX lessons to the asset and wealth management industries? I believe that we can – in fact we must – and that the industry will be much better off when we do. Here’s why:

- Technology and data have changed the world. Technology raises the bar and levels the playing field for every industry; businesses can either embrace technology and harness data to meet clients’ higher expectations or be left behind. SpaceX energized a stagnant industry and displace entrenched competitors.

- The rate of change is increasing exponentially. Change is happening faster and competitive forces are stronger than ever – meaning companies must push to innovate. The tactics that have made most companies successful in the last thirty-years are not likely to be the ones that will make them successful in the future. SpaceX’s M.O. is to seek out change to continuously improve its processes.

- Innovation is the antidote for stagnation. For over 50 years, projects in the space industry were so expensive, the risks were so great, and lead-times were so long, only the government could take them on. (It didn’t help that entrenched contractors had almost no incentive to innovate). High costs made it difficult to justify the existence of the U.S. space program – until SpaceX came along. Elon Musk radically changed the industry by automating, cutting costs, and using technology to spark advances.

What does this have to do with active fixed income management? This industry also suffers because of the high cost of service and a lack of innovation. Fixed income managers are dealing with passive-driven fee pressure, low interest rates, and increasing competition. We can apply the lessons learned from Musk’s transformation of space to help the fixed income investment industry thrive.

Technology will continue to play an increasingly vital role in active managers’ ability to succeed. Active fixed income managers must embrace new approaches using technology, especially because fixed income has a low ceiling for outperformance. They must maximize the alpha they can generate, and automate processes to increase efficiency and reduce costs wherever possible, to protect profits.

Active fixed income managers can learn key lessons from SpaceX in three areas: Vendor management, process management, and relationship management.

Lesson #1 – Assess the role of vendors at your firm

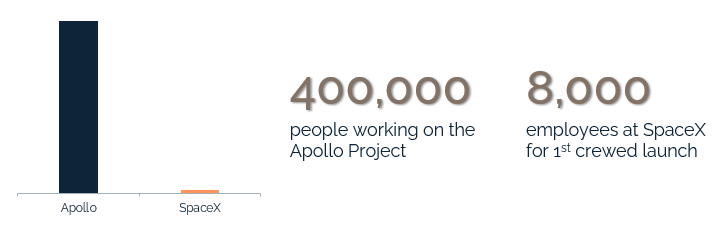

Before SpaceX, vendor management did not exist in the space industry; everything was either built by NASA or contracted out to one or two firms. As a result, over 400,000 people worked on the Apollo Project, while SpaceX had only 8,000 employees at the time of its first crewed launch.

SpaceX outsourced wherever possible, relying on the expertise of a wide range of vendors rather than building everything in-house. SpaceX uses off-the-shelf offerings where possible and partners with a number of vendors to build customized components that create “best-in-class” solutions. They only build from scratch if there is truly no viable alternative.

The active fixed income industry must do the same. Buy off-the-shelf solutions when suitable. Otherwise, partner with a vendor whose tools allow you to create customized solutions to meet your needs. Work with a number of providers – new technology is making integrations simpler than ever. A best-of-breed approach leverages expertise and is much faster to implement than building and managing an in-house system. Homegrown systems require a costly, dedicated staff to support them and quickly become stale.

Lesson #2 – Improve process management

Before SpaceX, the space industry lacked automation – most things were hand-built. Not surprisingly, that led to errors and quality control problems, but more importantly, processes were not scalable. The lack of automation also made every service, such as carrying people and cargo into space, extremely expensive.

SpaceX focuses on automating as much as possible. They use robots (learning lessons from Tesla’s assembly lines) to manufacture rocket engines. They saw the need to upgrade technology in order to make reusable rockets, which dramatically reduces costs. In addition, to further drive costs down and improve efficiency, SpaceX focuses their innovation on technology that automates and scales processes. For example, it cost NASA $55,000 to send one kilo (a water bottle) into space. SpaceX was able to reduce that cost 20X to $2,700/kilo in an industry where precision really matters, without sacrificing quality.

The active fixed income industry must do the same. With the right technology, active fixed income managers can deliver customized solutions in a scalable manner. That means using technology to analyze and optimize portfolios at scale, rather than one at a time, while still meeting each client’s unique objectives. Automation reduces errors (such as erroneous trade inputs, accidental investment policy violations, etc.) and gets rid of manual hand-overs that create weaknesses in critical processes. By reducing the time, effort, and cost of accomplishing tasks, technology gives managers more time to do the things they do best – including bringing in new assets. Since active management can cost up to eight times more than passive, scaling processes and preventing errors can be the difference between running a profitable business and perishing.

Lesson #3 – Understand what “relationship” means today

The space industry had become complacent, largely as a result of its relationship-based way of doing business. Contracts were “Cost +” (vendors simply added a percentage to the cost of goods to make a profit). Expensive dinners celebrated contracts that always went to Boeing or Lockheed. SpaceX challenged the assumption that decades-long relationships would always dominate, using innovation and the cost advantages it offered to create a compelling proposition.

SpaceX used its innovative approach to prove that it could deliver. They could not replicate the long-standing relationships that traditional aerospace contractors enjoyed; instead, they demonstrated that those relationships were not as critical when SpaceX’s offering was superior, at a much lower cost.

The active fixed income industry must do the same. Active management is also relationship-driven, and those relationships still matter. However, active fixed income managers must redefine the role of relationships in today’s environment. Clients today expect more (remember, technology raises the bar in every industry). They embrace technology, expect it to improve their lives better, and are cost-sensitive. For example, while court-side seats may be appreciated, they may not carry the same weight in the big scheme of the evolving client experience. The client experience will continue to evolve to rely more heavily on customization, proactive communication, and more value-add services. However, without the right technology, it would be difficult, if not impossible, to provide this type of service to every client. Innovation is required to provide investment managers the capacity to meet and exceed the higher standards that exist in the new client experience.

3 key takeaways for active fixed income managers

I do not mean to suggest that a firm has to be run by someone like Elon Musk to succeed – he’s a once-in-a-generation phenomenon. But there are many lessons to be learned from him and the companies he has built. To summarize:

- Lesson 1: Avoid the burden associated with building in-house or sticking with legacy technology. Partner with specialized vendors to achieve the best solutions.

- Lesson 2: Leverage technology to automate and scale so you can reduce costs and deliver customized solutions for your clients.

- Lesson 3: Be bold. Avoid complacency to stay relevant. Continue to look for ways to innovate and add value in your arena.

Elon Musk used technology to innovate in the space industry, and innovators in the bond market will capitalize on technology to set themselves apart. At IMTC, we help these firms transform their fixed income investment systems and workflows.

Want to see how IMTC can help your firm? Talk to our team.

Technology is only as good as how it is used. IMTC is designed by and for fixed income professionals, empowering them to take action and make decisions quickly and accurately with real-time data and analytics capabilities. It allows you to future-proof your business; driving operational efficiencies, mitigating risk and delivering performance, to ultimately enable business growth.