Release Notes: Modernize Client Proposals, Model Cash Flows, and Enhance Option-Adjusted Calcs

Show, don’t tell: Win new business by demonstrating proposed portfolios

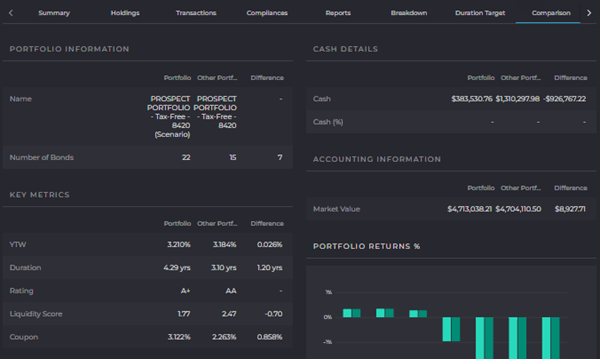

Promising improved portfolio performance is foundational to pitching new clients but showing prospects exactly what changes your firm would make to their portfolios goes a long way toward winning new business. With IMTC’s latest update, users can upload prospective clients’ portfolios to our system and run optimizations without impacting your total holdings. Then, firms can export a sleek report to demonstrate how they would execute on the promise of better performance with specific examples from clients’ actual portfolios.

“IMTC’s system turned what was a time-consuming, boring process of comparing bonds in a spreadsheet into a clean, visually appealing report to show a prospective client. The process is simple and an effective tool for small and big firms alike.”

—Melissa Robles, client relationship specialist at Carmichael Financial, LLC

Now, using IMTC’s new prospect portfolios capability, you can:

- Use IMTC’s full suite of features – including the Optimizer – on prospect portfolios without impacting existing total holdings

- Demonstrate the tangible changes you would make to a prospects’ portfolio with the platform’s reporting capabilities

Cash flow modeling to better fulfill ad hoc client requests

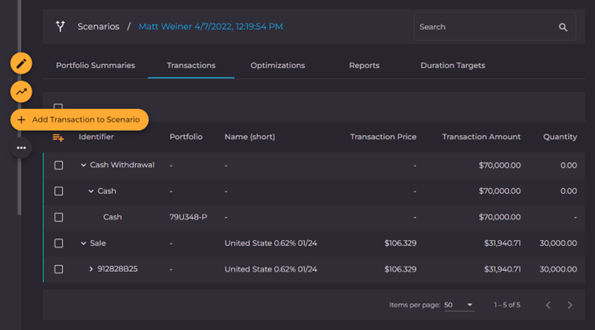

For wealth managers, executing ad hoc cash withdrawal requests from clients while maintaining optimal portfolios can be challenging. These requests often entail large sums and quick turnarounds, making it difficult for portfolio managers to ensure they fulfill the request while safeguarding the portfolio’s performance. Now, IMTC’s system allows portfolio managers to model how cash flows – withdrawals or contributions – will impact the portfolio using the Scenarios module. For example, clients may want to withdraw cash to settle an upcoming tuition payment for their child. Using IMTC’s Optimizer within the Scenarios module, PMs can draft the best strategy to raise the necessary cash without actually executing on it until desired.

Now, using IMTC’s new cash flow modeling, you can:

- Fulfill ad hoc cash requests using IMTC’s Scenarios and Optimizer modules while maintaining the portfolio’s structure and limiting gains/losses

- See the impact of the Optimizer’s suggested buys/sells within the Scenarios module and adjust as necessary before carrying them out

- Compare the model’s outputs to the original portfolio using IMTC’s Comparison tool

Integration with Kalotay models for enhanced option-adjusted calculations

IMTC has expanded its analytics to include Kalotay’s industry-leading fixed income valuation methodologies. Kalotay was instrumental in the development of option-adjusted spread (OAS) models for some of the most established financial technology providers in market today. Now, IMTC’s system calculates option-adjusted metrics using Kalotay’s proprietary models and formulas, while utilizing the data and analytic source of your choice. This means you execute more informed strategies, knowing our system has normalized variable bond structures (i.e., bonds with and without options); and in turn, you will see a clearer picture of how interest rate risk will impact your clients’ portfolios.

Now, with Kalotay’s libraries and models integrated into IMTC, you can:

- Work from comprehensive models that enable more accurate option-adjusted yield, duration, convexity, and spread projections

- Leverage Kalotay’s extensive suite of analytics tools, including BondOAS, MuniOAS, FloatVal, and TipsVal

- Improve relative value decision making with muni-specific OAS measures

For information on IMTC’s investment management platform, please contact team@imtc.com or reach out to our team.