Release Notes: Structured Products, Model Portfolios, Trading Enhancements, and Yield Curves

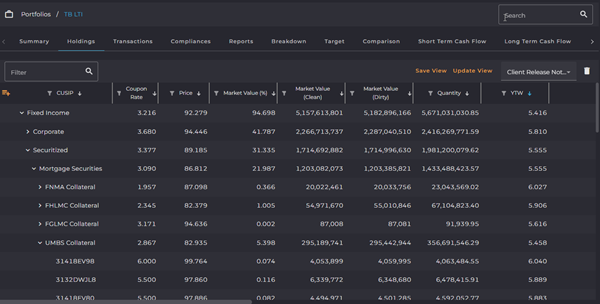

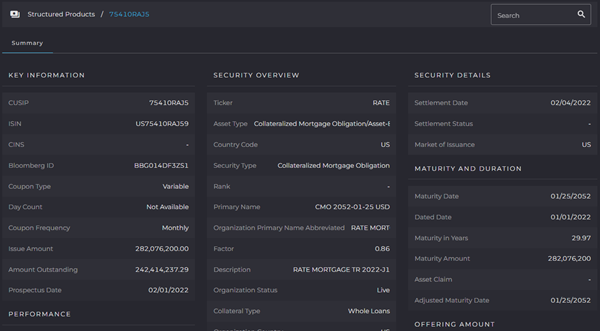

Access and analyze structured products

Enhance your ability to manage portfolios that hold structured products with an additional 1.7 million securities supported on our platform, including mortgages, asset-backed securities, and CMBS. The addition of structured products enables you to do more in-depth analysis and optimize decision-making since you can view terms & conditions, yields, risk metrics, and more, supported by ICE Analytics.

With structured products, you can:

- View data and customize data sets

- Trade securities via integrations to execution partners

- Maintain compliance rules

- Assess portfolio risk and optimize portfolios

Manage model portfolios with ease

Enhance your ability to manage model portfolios so you can offer unparalleled customization while maximizing your efficiency. With the capability to write nuanced compliance or investment target rules in relation to an index value, our Model Portfolio functionality allows you to create a robust framework for all your portfolios. Simply maintain a model portfolio to represent your desired allocation or point to an index you want to track. Rule-based management aligned with the model means you can swiftly identify necessary adjustments across all portfolios you oversee, securing alignment and strategic fidelity. Ultimately the feature gives you seamless integration of compliance, real-time trade impact, and the ability to employ multiple strategies with shared compliance infrastructure.

With the new model portfolio functionality, you can:

- Track your strategy: Assign an index, maintain a model, or use an existing lead portfolio as the benchmark for comparison.

- Maintain model portfolios: Keep a firm handle on model portfolios within IMTC, whether they represent actual portfolios or simply conceptual frameworks.

- Create & automate rules: Embed tailored compliance or investment target rules aligned with your strategic benchmark, which automatically updates when there are changes to model portfolio.

- Visualize data: Analyze your portfolio with intuitive data visualization tools that enable you to compare against your model.

- Trade in real-time: Monitor and conduct trades instantly, with the model portfolio maintaining a real-time reflection of potential and actualized transactions.

Streamline trade reconciliation with integration into Flyer

Enhance trading operations and efficiency with IMTC’s new integration into Flyer. This integration enables seamless trade matching, downstream reporting to custodians, and end-of-day processing for portfolio aggregators, facilitating reconciliations and tri-party reconciliation processes.

With the new integration into Flyer, you have access to:

- Intraday trade matching with CTM: Enable seamless trade matching via CTM and the risk of trade breaks is minimized, ensuring smoother trade execution processes.

- Automated custodial reporting: Simplify communication of trades by effortlessly generating and sharing trade reports with downstream custodians.

- Reconciliations with portfolio aggregators: Enhance end-of-day processing of positions and trades with portfolio aggregators, aiding in reconciliations and tri-party reconciliation processes.

View yield curve charts

Make informed decisions and navigate changing rate environments with our new yield curve charts. Visualize the data behind the calculations to stay on top of market trends and interest rates, empowering you with valuable insights for strategic allocations.

Enhanced OMS/Blotter for seamless trading operations

Experience enhanced trading workflows to ensure precision and accuracy in your trades. Automate data transfers to minimize errors, gain valuable visibility into trades, and effortlessly send trades to execution venues, empowering you to make informed decisions efficiently.

With the new enhancements to our OMS and Blotter, you have access to:

- Validation checks for executions: Verify adherence to compliance rules with the newly added validation check before sending orders for execution.

- Executions dashboard: View a customized overview of your execution data with filterable fields, providing you with enhanced visibility and control over your trades.

- Integrations with Bloomberg and BondPoint: Seamlessly send trades from the IMTC Blotter directly to your execution management system.

For information on IMTC’s investment management platform, please reach out to our team.