Release Notes: Enhanced Compliance Controls, Portfolio Segmentation, and Cash Modeling

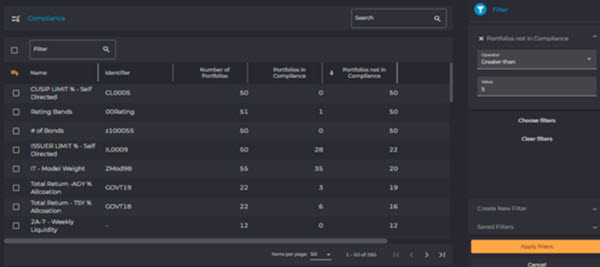

Ensure compliance with increased control and visibility

One of IMTC’s unique differentiators are the embedded compliance rules in the platform’s decision support tools; these provide portfolio managers enhanced control in keeping portfolios in line with specific strategy, targets, and portfolio guidelines. By expanding the types of fields that can be turned into a compliance rule, PMs can align investment preferences even closer to actionable outcomes. Additionally, adding filters to compliance rules enables managers to act on out-of-line portfolios even faster.

Now, with expanded compliance functionality, you can:

- Designate compliance rules by sleeve and set target allocation percent rules

- Create new compliance rules on the following fields: Pre-Refunded, 144a, Rank / Subordination, Country, and Currency

- Use compliance dashboard to filter by compliance rules, providing additional visibility into accounts that need action

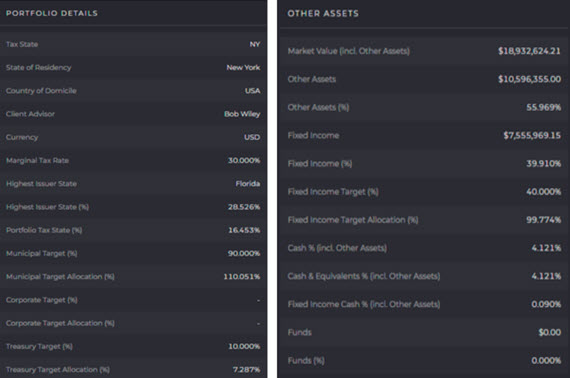

Manage segmented portfolios more effectively with greater transparency and flexibility

Including ‘Other Assets’ (Non-Fixed Income positions) as they relate to your Fixed Income target allocations is critical when making investment decisions. Now, managers can view a complete picture of all assets within their fixed income management platform. Additionally, sector sleeve management has never been more streamlined: the platform’s custom target allocations pair with customizable rules that can measure exposures within multiple segments. Asset targets and rules can be imported through integrations, manual imports on the fly, or standardized files into IMTC’s data agnostic API.

With this latest update, IMTC has created more precise ways to distribute assets within portfolios, granting wealth managers greater visibility and control over how to manage sleeves within a portfolio.

Now, using IMTC’s target allocation fields, you can:

- Set target allocations for each sleeve: municipals, corporates, Treasuries, and agencies

- View more granular metrics on other assets, including fixed income target and fixed income cash allowances

- Import and manage high-level metrics for non-fixed income assets

- Use your sector sleeve constraints across platform modules, including optimization, scenario analysis, and compliance to make more informed decisions

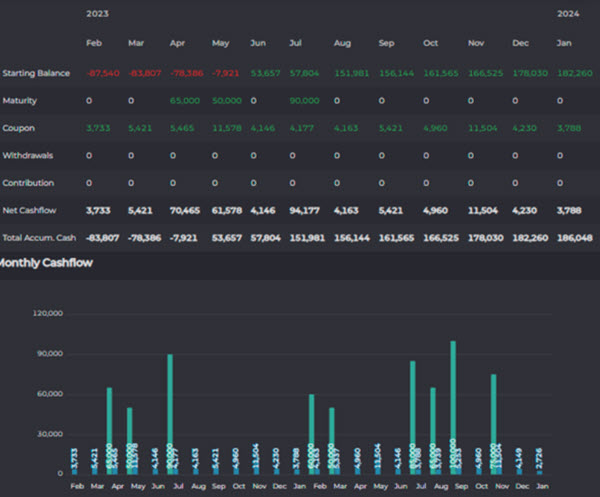

Visualize cash flows across present and future states

Often, it is difficult for asset managers to quickly visualize present and future states of portfolio cash flows, especially when incorporating ad hoc cash requests. This can make decision-making challenging and inaccurate.

IMTC’s new Short-term and Long-Term Cashflow tools help overcome this by supporting a reconciliation process to record and acknowledge when a cashflow happens, versus when it is expected. These features lay the foundation for future platform enhancements to bring greater utility and awareness around cash flows in general.

Using new cash flow tools, you can:

- Add ad hoc cash flows (contributions or withdrawals) to portfolios, then instantly visualize their impact

- Make faster, more accurate decisions with a detailed asset summary and compliance rules that instantly incorporate expected inflows and outflows

For information on IMTC’s investment management platform, please contact info@imtc.com or reach out to our team.