Release Notes: Shock Analysis, Managed Securities, Report Sets, and Enhanced Trading

Unlock a deeper understanding of your portfolio’s resilience to interest rate movements

While no one can accurately predict changing market conditions, the next best thing is being able to show clients exactly how their portfolio will fare in any scenario. The ability to assess the risk/reward profile of your portfolios in varying interest rate environments enables you to gain a deeper understanding of your positioning. . Our enhanced Shock Analysis module can simulate customized, parallel and non-parallel shifts in an instant across multiple portfolios to give you (and your clients) confidence within fluctuating market conditions.

With Shock Analysis, you can:

- Instantly model any interest rate conditions– from best-case-scenarios to a Great Depression or Taper Tantrum

- View the long-term impact of potential trades

- Generate shock analysis reports and easily showcase portfolio strength to clients

- Evaluate risk at scale, then take informed action across portfolios

Gain complete control and flexibility over your data

In order to accurately report on portfolios, many firms need to adjust security level classifications, analytics, obligors, or other terms and conditions. Additionally, while using a turnkey platform, firms need to have custom fields enabling you to add internal bond ratings, relative value recommendations, or whatever labels you choose. With our new Managed Securities module, you can filter from our Securities Universe of 1.4 million bonds and generate a custom data set for your firm’s environment.

With the new Managed Securities module, you can:

- Add custom fields to any bond – internal scores, recommendations, and spread targets

- Edit data on a bond, including sector classifications, analytics, security type, obligor, issuer name, ultimate parent name, and more

- Apply custom data across all of IMTC’s portfolio management tools to control investment decisions more effectively

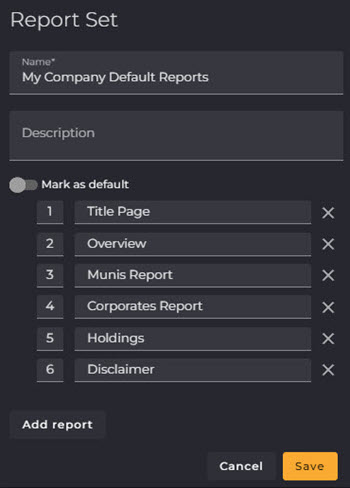

Run custom reports with modular sections for clients and stakeholders

Accurate reporting is the foundation of effective client communication. When you need reporting for various audiences or clients, you need the flexibility to choose the data required for each report. With Template Sets, you can now build custom aggregated reports from existing report sections. Create custom, holistic report templates for different audiences or client types – then run them at any time.

With Report Sets, you can:

- Select individual report sections to add to your template, including cover page, breakdown, key analytics, holdings, disclaimers, and more

- Instantly generate customized reports for clients or stakeholders

Manage trade strategy, order management, and execution from one place

At IMTC, our goal is to create a true end-to-end fixed income management solution, eliminating the need to spend hours tabbing between separate software in your daily workflow. With that core tenet in mind, we’ve made several enhancements to manage and execute orders directly from IMTC’s platform. Our team enhanced functionality to the Blotter and built a FIX engine with integrations into BondPoint and Bloomberg TSOX.

New trading functionality includes:

- FIX connectivity: Send trades directly from the IMTC Blotter to an execution management system

- Settlement details: Connectivity into execution platforms provides two-way communication to see full settlement details of executed trades

- Unallocated trades: View and track any trades made in other platforms, then run compliance checks and allocate within IMTC

- Block orders: Use enhanced filtering to block orders by CUSIP, portfolio, or strategy type to trade more effectively

- Blotter UI enhancements: Set default preferences including filtered views for today’s or open orders and save column sets to see the data you need

For information on IMTC’s investment management platform, please reach out to our team.